Market Analysis

In-depth Analysis of Wearable Payment Device Market Industry Landscape

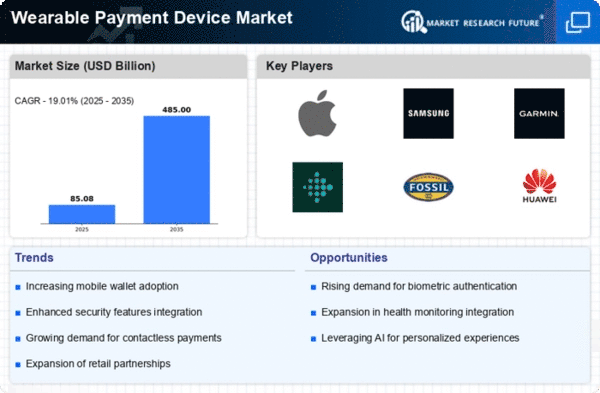

The Wearable Payment Device Market is seeing huge movements powered by the rising reception of computerized payment arrangements, headways in wearable innovation, and the developing inclination for helpful and contactless exchanges. This market dynamic is impelled by an intermingling of elements, including the rise of portable payment ecosystems, the incorporation of payment functionalities into wearable devices, and the changing customer conduct towards more reliable and secure payment techniques. One of the key drivers affecting the Wearable Payment Device Market is the boundless reception of computerized payment systems. As purchasers progressively embrace credit only exchanges and versatile payment applications, there is a developing interest for wearable devices that can work with these exchanges easily.

Wearable payment devices, including smartwatches, wellness trackers, and payment-empowered gems, offer clients the accommodation of making secure transfers without the requirement for actual cards or money. Progressions in wearable innovation assume an urgent part in forming market elements. Wearable payment devices are developing past direct health following and notice highlights to consolidate secure payment functionalities. These devices influence advances like Near Field Communication (NFC) or Radio-Frequency Identification (RFID) to empower consistent contactless payments. The combination of biometric authentication strategies, for example, finger impression checking or pulse acknowledgment, upgrades security and adds an extra layer of insurance to wearable payment exchanges. The changing scene of retail and business is adding to the growth of the Wearable Payment Device Market. Retailers and organizations are progressively taking on contactless payment terminals, establishing a climate helpful for wearable payments.

The rise of versatile payment ecosystems and advanced wallets is another huge variable impacting market elements. Wearable payment devices frequently coordinate with well-known versatile payment platforms, permitting clients to interface their wearable devices to their favored computerized wallet. This interoperability cultivates a consistent and interconnected payment experience, where clients can start exchanges utilizing their wearables and deal with their payment techniques through a combined computerized stage.

Leave a Comment