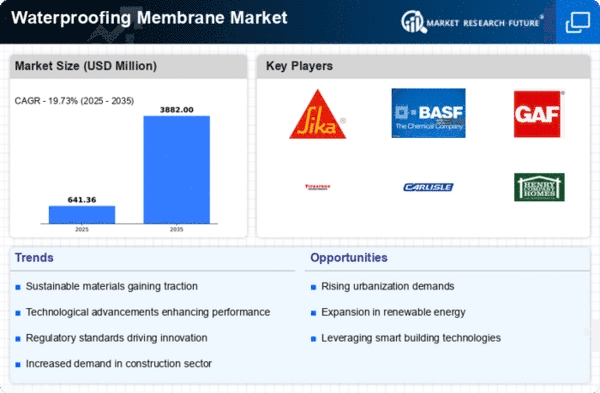

Market Analysis

In-depth Analysis of Waterproofing Membrane Market Industry Landscape

The surge in demand for 2K-polyurethane, particularly within two-component polyurethane liquid applied membrane solutions, has been remarkable over the past decade. This growth can be attributed to the efficient application method offered by the two-component technology, making it particularly well-suited for large surface areas and industrial applications. One of its standout features is its rapid curing property, allowing for swift over-coatings and significantly reducing application time.

Beyond its application efficiency, the two-component polyurethane liquid membrane boasts a wide array of physical and chemical properties that further fuel its demand. These include exceptional weather resistance and UV stability, making it resilient against harsh environmental conditions. Its mechanical and chemical resistance adds to its durability, while its fast drying capability at room temperature stands out as a practical advantage. Additionally, the coating's attributes such as excellent clarity, resilience, and an attractive finish have significantly contributed to its popularity in the market.

Another driving factor for the increased demand for 2K-polyurethane coatings is their eco-friendly nature. Being solvent-free and 100% solid, they present an environmentally conscious and sustainable waterproofing solution. This aspect aligns with the global push towards more eco-friendly construction practices and contributes to the rising preference for such solutions in liquid roofing systems. The combined benefits of these features—application efficiency, exceptional physical and chemical properties, and eco-friendliness—have collectively propelled the increasing demand for 2K-polyurethane coatings in the global liquid roofing market.

With an ever-growing emphasis on environmental concerns, both governments and end-users have significantly heightened their demands for green and eco-friendly coatings. This trend has been further amplified by consumers' increased focus on health, safety, and adherence to stringent environmental regulations within various coating application areas. Consequently, there's been a notable surge in customer demand for environmentally friendly products, which has motivated manufacturers to adopt practices that reduce the use of volatile organic compounds (VOCs) in coatings.

To address these concerns, manufacturers have shifted towards solvent-free coating products that prioritize environmental sustainability. Water-borne coatings, for instance, have emerged as an eco-friendly alternative as they contain minimal solvents, typically less than 5%, and predominantly use water as a diluent to disperse resin instead of organic solvents, which are known to emit VOCs. This transformation aligns with the increasing preference for environmentally conscious solutions.

The detrimental impact of VOCs on health cannot be overstated. VOCs are known to contribute to the formation of ground-level ozone and urban smog, both of which have adverse effects on human health and the environment. Ground-level ozone can exacerbate respiratory conditions, lead to lung inflammation, and aggravate asthma, among other health issues. Additionally, urban smog poses risks to the respiratory system and is a contributing factor to various environmental problems. Therefore, the shift towards solvent-free and water-borne coatings not only addresses environmental concerns but also positively impacts human health by reducing the harmful effects associated with VOC emissions. As customers increasingly prioritize health and environmental consciousness, the adoption of these eco-friendly coatings is expected to continue growing in response to these heightened demands.

Leave a Comment