Waterproofing Chemicals Size

Waterproofing Chemicals Market Growth Projections and Opportunities

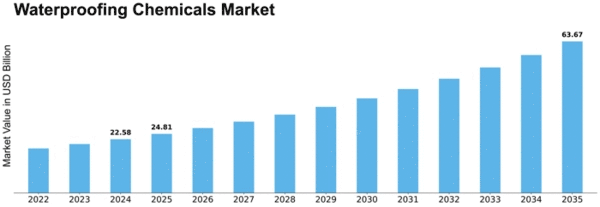

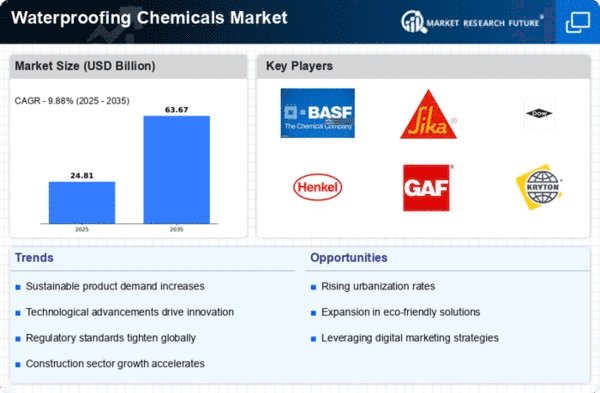

Waterproofing chemicals are in high demand due to shifting weather patterns and rising building. Waterproofing Chemicals Market Size was $15.5 billion in 2021. The waterproofing chemicals business is expected to increase from USD 17.02 billion in 2022 to USD 32.88 billion by 2030, a 9.88% CAGR.

The Waterproofing Chemicals industry depends on regulations and construction requirements. As governments and regulatory agencies worldwide enforce tight construction and infrastructure requirements, waterproofing chemicals that conform are becoming more important. Standards ensure structural safety and quality and stimulate waterproofing formulation innovation to satisfy industry needs.

Economic conditions worldwide affect the Waterproofing Chemicals market. Economic volatility, currency exchange rates, and geopolitics affect construction, price, and market stability. Waterproofing chemical demand is directly affected by the construction and infrastructure sectors' economic condition. Market stakeholders and manufacturers must manage these macroeconomic aspects to adapt to changing market conditions and make informed business decisions.

Technological advances drive the Waterproofing Chemicals industry. Waterproofing chemical performance, adaptability, and sustainability are constantly improved through research and development. Formulation innovations including eco-friendly and self-healing waterproofing chemicals answer industry needs and environmental concerns.

Waterproofing Chemicals market dynamics are shaped by consumer choices and industry developments. Low-VOC waterproofing chemicals are developed due to the growing awareness of sustainable construction methods and the demand for environmentally friendly solutions. The construction industry's use of modern materials and technologies increases demand for waterproofing chemicals.

Geography affects the Waterproofing Chemicals market. Regional temperatures, building practices, and construction materials affect global market dynamics. Each region has different conditions and tastes, so manufacturers must alter their waterproofing chemical solutions to meet local standards and market trends.

Waterproofing Chemicals market dynamics are shaped by industry competition. Research collaborations, strategic partnerships, and product diversification tactics affect competition. Brand recognition, quality assurance, and novel waterproofing compositions help companies compete in the market."

Leave a Comment