North America : Water Flosser Innovation Leader

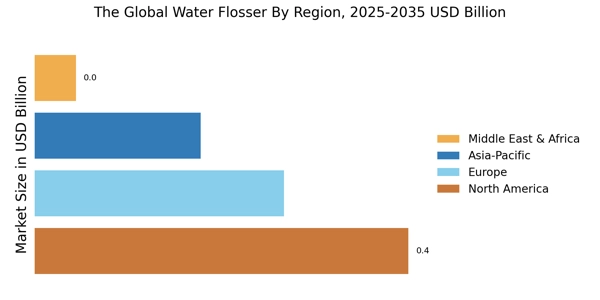

As of 2023, North America accounts for about 36.33% of the entire revenue of the water flosser market across the globe, thus being the largest continent in this market. Awareness of oral hygiene, good dental care infrastructure, reimbursement policies, and accessibility to advanced personal care products are some of the reasons that are credited for this region. The population shows a tendency towards preventive health care, along with strong avenues by professional dental organizations that encourage daily oral hygiene routines. Increased prevalence of periodontal diseases and gingival inflammation is one of the major contributors driving North America's water flosser demand.

As per the data provided by the Centers for Disease Control and Prevention (CDC), almost 42% of adults above 30 years suffer from periodontitis in the United States. The consumable increases have further led to the consumer interest in proper, home-at-source solutions to poor oral hygiene. Market analysis suggests the effectiveness of water flossers in being easy and superior in performance for plaque reducing and bleeding as compared to traditional string flosses.

Europe : Water Flosser Market with Steady Growth

The second largest regional market in the global water flosser industry in 2024 is that of Europe, which accounts for an estimated 28.33% share of global sales. The growth in the region is supported by high oral health standards, numerous awareness campaigns, strong public healthcare systems, and favorable consumer attitudes towards advanced personal care devices. Dental health is considered a significant domain in public health policy across Europe, and several countries partly reimburse dental care products and services, which fosters the uptake of preventive oral hygiene tools such as water flossers.

The dental system in Germany, one of the largest revenue generators in the region, is very structured and emphasizes prevention, while with obligatory insurances, the consumers exhibit a great receptiveness towards dental innovations. In these households where high-performance oral care is prioritized, water flossers are the preferred product. France is also becoming a growing market for this equipment, in part due to the French Union for Oral Health and national campaigns that educate about interdental cleaning. Increasing numbers of consumers, especially youngsters seeking alternatives to traditional flossing, are embracing water flossers as an integral part of their routine.

Asia-Pacific : Water Flosser Rapid Growth Hub

The Asia-Pacific region is the fastest-growing market for water flossers, claiming approximately 24.00% share of the revenue worldwide in 2023, and promising robust growth in the future on account of increasing oral health awareness, rising income levels, urbanization, and a growing middle-class population. The region also portrays heavily invested healthcare infrastructures with an increased prevalence of dental disorders like gingivitis and periodontitis, especially across the developing economies. In China, the extremely rapid growth of the market is largely due to state-sponsored programs like the "Healthy China 2030" scheme that aim at bettering public awareness of oral health and preventive care methods. Water flossers are now being adopted more on an individual basis among Chinese consumers, particularly in the urban agglomerations, where the use of e-commerce and technology is relatively high.

Online retailing has been massively used by both local and internationally renowned brands such as Xiaomi, Philips, and Panasonic during big sale festivals just to gain traction. Another reason for such rapid acceptance in India is increasing dental care awareness, changing urban lifestyles, and rising health consciousness amongst the younger generation. Water flossing is still not adopted in rural areas, but it is gaining acceptance in metro areas like Delhi, Mumbai, and Bangalore, and among working professionals and youth. The awareness campaigns and public initiatives by the Dental Council of India are encouraging better practices in this regard.

South America: Water Flosser Adoption on the Rise

South America is a developing region with increased importance in the global water flosser market. The region shares only a small part of the global revenue but has strong potential for growth from increased awareness of oral hygiene, improving middle-class incomes, and better access to personal care technologies. The region's populace is becoming increasingly health-conscious, with governments taking preventive healthcare measures, including dental care. The largest and most dynamic market amongst South American nations is Brazil. With a population above 215 million and a well-established system of public oral health care by the Brazilian Unified Health System (SUS), Brazil has made substantial contributions to the promotion of dental hygiene.

Dentists under the Brazilian Dental Association are now stimulating a lot of interdental cleaning, while consumers in big urban centers like São Paulo, Rio de Janeiro, and Brasília have shown a growing interest in technologically advanced oral care devices-water flossers. Adoption is increasing, especially among younger consumers and working-class individuals, heavily influenced by social media, favoring modern and convenient solutions instead of traditional floss.

Middle East and Africa : Water Flosser High-Growth Potential

MEA is the growing and ever-changing market within the global overview of water flossers, and although it is still a minor revenue contributor to overall global revenue, it is fast becoming a market with growing potential due to the evolving healthcare infrastructure, urbanization, rising dental awareness, and growing e-commerce penetration. Transforming consumer behavior toward individual wellness and preventive healthcare supports the region's general growth, with oral hygiene being one of its recognized pillars of general health. The Gulf Cooperation Council (GCC), that is, UAE, Saudi Arabia, Kuwait, Qatar, Bahrain, and Oman, with high per capita income, have developed healthcare systems, and the impact of global health trends has served as a propelling factor for the adoption of modern oral care devices. In these countries, public health agencies like the Ministry of Health in the UAE and Saudi Arabia are kick-starting oral health promotion programs within schools and workplaces, advocating interdental cleaning daily. Water flossing for urban consumers in Dubai, Riyadh, and Doha is set to entice especially high-end and rechargeable flossers, an attraction to tech-savvy customers and their aesthetics. Importantly, international retail giants in combination with established online marketplaces pave the way to consumer access to state-of-the-art dental products in the GCC region.