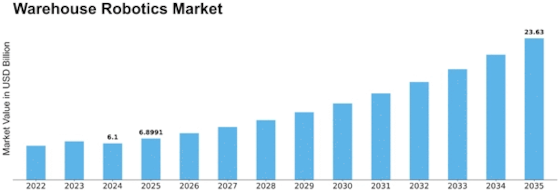

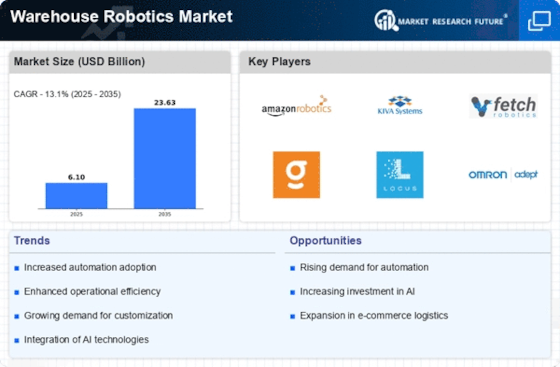

Warehouse Robotics Size

Warehouse Robotics Market Growth Projections and Opportunities

Many forces are at play in the growth and direction of the warehouse robotics market. One of the biggest forces driving this market forward is unflagging pursuit of operating efficiency. Warehouse robotics are now being applied in increasingly numerous fields, automating a far wider variety of tasks on the supply chain and logistics sides. For factory managers, investing in robots not only raises efficiency but also reduces costs. Such factors as cost considerations and the pursuit of cost-effectiveness are playing a role in influencing warehouse robotics adoption. Starting up robotic systems costs a considerable sum, but companies are attracted to the prospect of cheaper labor, higher operational efficiency and fewer errors in order fulfillment over the long term. The lower cost of robotic solutions, because of increasingly advanced Technology, makes automation more and more attractive economically to every business. The warehouse robotics space is one with a large cast of characters, from industrial automation heavyweights to the hottest startups. It also stimulates creativity, as firms try to create something unique by developing revolutionary robotic technology. This is because robotics technologies are continually being upgraded and new products coming onto the market. As a result, firms face very lively environment making many choices based upon requirements. Another driving force is the incorporation of AI and IoT into warehouse robotics. These AI algorithms allow robots to modify their decision-making procedures, as well as learn from experience with environment can be customized and routes planned optimally. Meanwhile, real-time monitoring and data collection are made possible by Internet of Things (IoT) connectivity. This has given businesses important information about how their warehouses are run. With the combination of AI and IoT with warehouse robotics, this interactive synergy not only brings about greater work efficiency but also helps build intelligent, interconnected warehouses.

Leave a Comment