Warehouse As A Service Waas Size

Warehouse as a Service WaaS Market Growth Projections and Opportunities

Modern businesses encounter challenges such as varying demand, seasonal peaks, and the necessity for rapid scalability. Warehouse as a Service (WaaS) has emerged as a solution, offering on-demand storage and fulfillment services that empower businesses to adapt their warehousing requirements in response to demand fluctuations. This flexibility is particularly advantageous for business owners in diverse industries, including e-commerce, retail, manufacturing, and logistics. As e-commerce and omnichannel retail continue to grow, there is an increasing demand for agile and efficient warehousing services. WaaS providers offer services such as order fulfillment, inventory management, and last-mile delivery, supporting e-commerce operations with infrastructure, technology, and expertise. The convenience and cost-effectiveness of WaaS make it an attractive option for businesses seeking online visibility and multiple customer reach options.

Providers of Warehouse as a Service leverage technology to optimize warehouse operations. Automation technologies, including robotics, conveyor systems, and autonomous vehicles, enhance the efficiency, accuracy, and speed of order fulfillment. Additionally, the integration of Internet of Things (IoT) devices and data analytics enables real-time monitoring, predictive analytics, and inventory optimization, further elevating operational performance. This technological integration positions WaaS as a forward-looking solution aligned with the evolving needs of modern businesses.

For businesses expanding globally, establishing warehousing solutions in different regions and countries becomes imperative. WaaS providers address this need by operating a network of warehouses strategically located across the globe. This global reach, combined with expertise in international logistics, makes WaaS an appealing option for businesses looking to expand their supply chains efficiently.

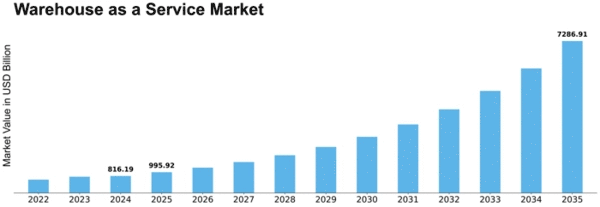

According to market research from MRFR, the global Warehouse-As-A-Service (WaaS) market has witnessed significant growth, projecting to reach USD 2,469.5 Million by 2030 at a Compound Annual Growth Rate (CAGR) of 20.5% during the forecast period from 2023 to 2030.

In terms of regional leadership in the global Warehouse-As-A-Service (WaaS) market, North America took the lead in 2022 with a 35.97% share, followed by Asia Pacific and Europe with shares of 29.78% and 25.76%, respectively. The Asia Pacific region's rapid economic development, the surge in e-commerce activities, and the increasing demand for flexible and scalable warehousing solutions contribute to its noteworthy market growth.

The segmentation of the global Warehouse-As-A-Service (WaaS) market includes categories such as type, customer type, end-user, and region. General Warehousing, SMEs (Small and Medium-sized Enterprises), and E-Commerce Companies are identified as key segments, with significant market shares and projected growth rates. Specifically, General Warehousing accounted for the largest market share in 2022, and SMEs and E-Commerce Companies are expected to maintain their prominence during the forecast period. Additionally, within the Businesses sub-segment, Consumer Goods/Retail led the market share in 2022 and is anticipated to exhibit substantial growth during the forecasted period with a promising CAGR of 21.6%. These insights reflect the dynamic landscape and promising outlook of the global Warehouse-As-A-Service (WaaS) market.

Leave a Comment