- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

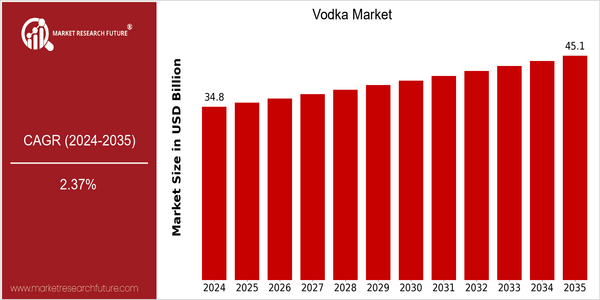

| Year | Value |

|---|---|

| 2024 | USD 34.84 Billion |

| 2035 | USD 45.08 Billion |

| CAGR (2025-2035) | 2.37 % |

Note – Market size depicts the revenue generated over the financial year

The vodka market is expected to grow steadily from the current $34.8 billion to $45 billion by 2035. This would imply a CAGR of 2.37% from 2025 to 2035. Several factors are expected to drive this growth, including the rising popularity of premium and craft vodka brands that meet the evolving consumer preferences for quality and unique flavors. Moreover, the increasing popularity of vodka-based cocktails and the rising acceptance of vodka as a universal spirit are expected to drive growth. The technological advancements in vodka production, such as improved distillation and new methods of flavoring, are also expected to drive growth. The leading players in the vodka industry, such as Diageo, Pernod Ricard, and Bacardi, are focusing on product innovation and strategic alliances to enhance their market presence. Diageo’s launch of new flavored vodkas and Bacardi’s collaboration with mixologists to create signature cocktails are some of the recent examples of such strategies. The demand for a variety of quality vodkas is expected to drive the market in the coming years.

Regional Market Size

Regional Deep Dive

The Vodka market is characterised by a wide range of consumers’ preferences and a growing inclination towards premium and artisanal products in various regions. In North America, the trend towards artisanal brands is supported by the strong cocktail culture. Europe, on the other hand, remains a stronghold of the vodka category, with a long history of production. The Asia-Pacific region is experiencing strong growth due to the changing drinking habits and increasing availability of income, whereas in the Middle East and Africa the cultural and regulatory factors are still influencing consumption. Latin America is a new market for vodka brands, with the younger generations becoming more interested in international brands. The overall vodka market is experiencing strong growth, driven by innovation, cultural changes and changing consumer preferences.

Europe

- Eastern European countries, particularly Russia and Poland, continue to dominate the traditional vodka market, with brands like Stolichnaya and Żubrówka maintaining strong market positions.

- The trend towards flavored vodkas is growing, with companies like Absolut launching innovative flavors to cater to younger consumers seeking unique drinking experiences.

Asia Pacific

- The rise of premium vodka brands is notable in markets like China and India, where consumers are increasingly willing to pay more for high-quality spirits.

- Innovative marketing strategies, including collaborations with local influencers and mixologists, are being employed by brands like Smirnoff to penetrate the competitive Asian market.

Latin America

- The growing popularity of vodka-based cocktails, particularly among millennials, is driving demand in countries like Brazil and Mexico.

- Local distilleries are beginning to produce vodka using native ingredients, which is attracting interest from consumers looking for unique, locally-sourced products.

North America

- The craft vodka movement is gaining momentum, with brands like Tito's Handmade Vodka and Grey Goose leading the charge, emphasizing quality and local sourcing.

- Recent regulatory changes in states like California have allowed for more flexible distribution channels, enabling smaller distilleries to reach consumers more effectively.

Middle East And Africa

- Cultural and religious factors significantly influence vodka consumption in the Middle East, with brands like Russian Standard adapting their marketing strategies to align with local customs.

- The introduction of duty-free shops in airports across the region is providing new opportunities for vodka brands to reach international travelers.

Did You Know?

“Vodka is one of the most consumed spirits globally, with an estimated 4.5 billion liters consumed annually, making it a staple in many cultures.” — International Spirits and Beverage Association

Segmental Market Size

The premium vodka segment is a significant part of the overall vodka market, which is now experiencing a steady increase, driven by the growing demand for quality spirits. The trend towards artisanal distilling and the growing popularity of cocktails based on vodka in bars and restaurants are also important driving forces behind this growth. The fact that health-conscious consumers are increasingly opting for premium brands with natural ingredients and a clean label is also driving the growth of this segment. At present, the premium vodka segment is a mature one, with major players such as Grey Goose and Belvedere leading the market. These brands are often associated with luxury lifestyles and high-end venues. Hence, the main applications of premium vodka are in bars, restaurants and retail outlets, where the brands are positioned as the choice of sophisticated consumers. The trend towards sustainable development, whereby producers are focusing on sustainable packaging and production methods, is also driving growth. Lastly, the emergence of new technologies such as advanced distillation and flavouring methods is also driving growth.

Future Outlook

Vodka market to grow at a CAGR of 2.37% from 2024 to 2035. In the coming years, the global demand for premium and artisanal vodka will increase significantly, as consumers are increasingly looking for high-quality, artisanal products. Health-conscious consumers are also influencing the market, and low-calorie and organic vodka are gaining popularity. By 2035, the share of premium vodka will grow significantly, reaching up to 35% of the total market. Also, technological innovations and regulatory changes will continue to influence the development of the market. The innovations in the process of distillation and the addition of aromas will allow for the development of a wide range of products that meet the tastes and preferences of consumers. In addition, the increasing focus on sustainable development and the use of environmentally friendly production methods will have a positive effect on the positioning of brands and the loyalty of consumers. Also, the development of regulations aimed at reducing the negative impact of alcohol on consumers will affect the development of the market and will encourage producers to adopt more transparent and responsible marketing practices. In general, the vodka market will continue to develop, based on the combination of tradition and innovation, adapting to the changing environment of consumer preferences and regulatory conditions.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.78% (2023-2032) |

Vodka Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.