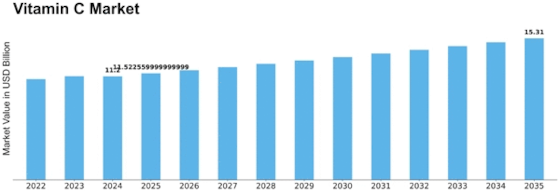

Vitamin C Size

Vitamin C Market Growth Projections and Opportunities

The Vitamin C market is influenced by a multitude of factors that collectively shape its dynamics and growth. A key driver for the expansion of this market is the increasing awareness of health and wellness among consumers. Vitamin C, also known as ascorbic acid, is renowned for its immune-boosting properties and its role in overall well-being. As consumers become more health-conscious, there is a growing demand for supplements and fortified foods that provide essential nutrients, including Vitamin C.

Changing dietary patterns and lifestyles also contribute significantly to the Vitamin C market's growth. Modern lifestyles often involve fast-paced routines, leading to a preference for convenient and easily consumable products. This has led to the incorporation of Vitamin C in various forms, such as supplements, beverages, and snacks, to cater to the needs of individuals looking for accessible ways to meet their nutritional requirements.

The global rise in aging populations is another crucial factor impacting the Vitamin C market. As people age, there is an increased focus on maintaining health and preventing age-related illnesses. Vitamin C, with its antioxidant properties, is perceived as a key element in supporting healthy aging. This demographic shift towards an older population fuels the demand for Vitamin C supplements and fortified foods, driving market growth.

Furthermore, the COVID-19 pandemic has played a significant role in shaping the Vitamin C market. The heightened awareness of the importance of a strong immune system has led to a surge in demand for immune-boosting supplements, with Vitamin C being a prominent choice. Consumers are increasingly seeking products that support their immune health, creating a market trend that is likely to persist in the post-pandemic era.

The influence of technological advancements is evident in the manufacturing and formulation of Vitamin C products. Continuous research and development efforts have led to innovations in delivery systems, such as liposomal encapsulation, to enhance the bioavailability of Vitamin C. These advancements not only improve the efficacy of supplements but also contribute to a more diverse range of Vitamin C-enriched products in the market.

Market competition and the presence of numerous players also impact the Vitamin C market. Companies engage in product innovation, strategic partnerships, and marketing initiatives to gain a competitive edge. The market's consolidation through mergers and acquisitions further intensifies competition and influences the overall market dynamics. These strategic moves by key players contribute to the introduction of new Vitamin C products and formulations, providing consumers with a variety of choices.

Government regulations and policies related to health claims and product labeling also play a significant role in the Vitamin C market. Compliance with these regulations is crucial for manufacturers to ensure the safety and quality of their products and to build and maintain consumer trust. Additionally, the market is influenced by international trade policies and regulations, impacting the sourcing and pricing of raw materials, which in turn affects the overall market landscape.

Leave a Comment