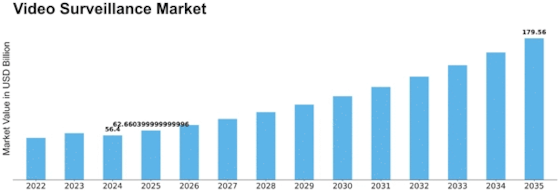

Video Surveillance Size

Video Surveillance Market Growth Projections and Opportunities

The growth of the video surveillance market is fueled by the increasing adoption of Internet of Things (IoT) applications, driven by the need for advanced security solutions. Video analytics play a crucial role in smart city projects, encompassing applications in smart buildings, traffic management, retail, and logistics operations. Video surveillance provides high-quality images for efficiently tracking and monitoring people, traffic, and various activities. Video analytics are employed for tasks such as face recognition, behavioral analytics, and predicting illicit actions in smart city projects that demand technologically advanced video surveillance solutions for real-time information and traffic monitoring.

Smart city projects offer intelligent warnings, including traffic alerts and disaster warnings, facilitating quick access to events and incidents. The rising demand for biometric applications, video management, and IoT are key factors propelling video surveillance applications worldwide. These projects integrate video surveillance systems to monitor traffic and public areas, ensuring the protection of individuals, equipment, and facilities, along with aiding in the investigation of criminal activities. The integrated solutions offer future-proofing, distributed intelligence, remote accessibility, reliability, and cost-effectiveness.

In India, the Gandhinagar Municipal Corporation partnered with Sterlite Technologies in 2017 to launch the Smart City project. This initiative was designed to manage various Smart City services, including city-wide Wi-Fi, smart street lighting, digital displays, speed and face detection systems, environmental sensors, public address systems, IP surveillance, automatic number plate recognition systems, a smart call center, and a centralized command center for monitoring and controlling all activities. The services encompass video surveillance systems, video management software, video analytics, and an operational command control center. Consequently, the growing demand for video surveillance in smart city projects is contributing to the market's expansion.

Leave a Comment