Market Trends

Key Emerging Trends in the Video Processing Platform Market

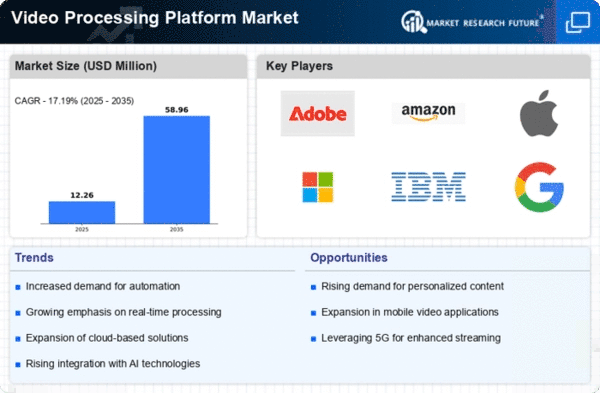

After 5G networks are built all over the world, the business of streaming videos is likely to change a lot. 5G's fast and smooth links will make videos better, which will make video editing tools more popular and grow the market. Video processing tools are useful in many business settings because they make videos clear and help people make choices more quickly. These settings include security and surveillance, streaming and programs, and more. Americans watched 169.4 billion minutes of streaming video in a week in February 2022. About 85% of homes in the US can now connect to at least one video streaming service. More people around the world will use the internet and connected devices like smartphones, tablets, and interactive screens to watch videos whenever they want over the next few years. This will cause a lot of growth in video processing solutions. An alarm system that records video and has tools for analyzing it can find many events. One example is Airport Council International (ACI), which picked OpenCV, a tool for processing videos that lets you find and follow things. ACI says that during busy hours, one plane moves every minute and that most airports move about 20 planes an hour. To keep track of traffic at the airport, you should know where a plane is once it lands. Working with the pilot and keeping an eye on what's going on in the airport's CCTV network are two ways to do this. It was added video processing features to the built-in CCTV system to make the process of finding planes automatic. The huge amounts of data that are created when movies are cut together are stored in the cloud. But these cloud-based systems are safer than systems that are kept on-site, which is why companies don't spend a lot of money on video processing tools. Privacy and security issues can also get worse when you process video data, especially when it comes to spying and video analysis. Also, following the rules for data security could hurt the success of this market, causing it to grow more slowly and give people fewer chances.

Leave a Comment