Market Trends

Key Emerging Trends in the Veterinary POC Diagnostic Market

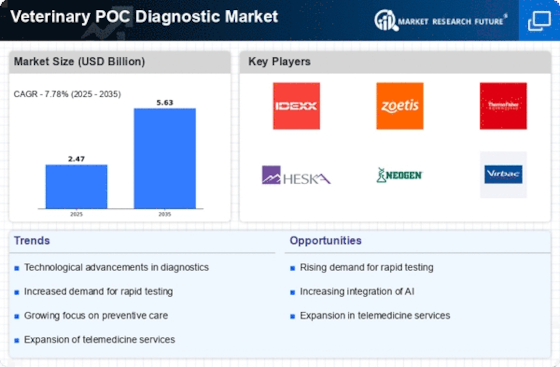

The veterinary point-of-care (POC) diagnostic market is witnessing significant growth, driven by the rising global trend of increased pet ownership. As more people bring pets into their homes, the demand for rapid and convenient diagnostic solutions at veterinary clinics and pet care facilities is on the rise. Technological development is molding market trends in veterinary PODs. The advent of portable and easily accessed diagnostic devices has streamlined quicker and efficient tests for different conditions in animals. These new developments contribute to better veterinary treatment and mobility in case of the sane people and vets. Increasing attention is paid to point of care testing of infectious diseases in the veterinary POC diagnostic market. Prompt and accurate diagnoses of diseases such as parvovirus, feline leukemia, and canine heartworm expedite timely medication initiation and prevent the transmission of infections between animals leading to improved health. The growing awareness of zoonotic diseases that can be transferred from animals to humans is impacting market dynamics. Veterinary point-of-care diagnostics significantly contribute to the prevention and control of zoonotic diseases and the health of both animals and humans caring for them. The veterinary POC diagnostic market has gained popularity globally, although, the growth in developing nations is expected to be prominent particularly because ofincreased interest by laboratories and producers. The rapidly growing role of veterinary medicine alongside an increase in disposable income were pushing the adoption of POC diagnostic tools in these areas which resulted in market expansion. An interesting trend in the field of veterinary POC diagnostics is AI and data analytics integration. The decision accuracy of the diagnosis is increased thanks to advanced algorithms in this way helping veterinarians create effective treatment plans according to individual animals. Among the preventive care that has gained popularity in the veterinary section, POC diagnostics are pivotal in the shift. Detection of conditions during routine testing enables early intervention before the condition progresses thereby contributing to the health and welfare of animals. The veterinary POC diagnostic market is adjusting to remote monitoring and telemedicine adoption for animals. Diagnostic instrumentation from POC for cancer detection including devices that support transmission of remote data enable veterinarians to monitor the health of animals remotely providing timely insights and reducing the need for regular visits. Animal diagnoses are becoming increasingly species specific. The veterinary POC diagnostic market is undergoing the development of focused tests and equipment for different type animals, fulfill species ranging from pet animals to livestock unique healthcare. Environmental testing for animal health is gaining prominence in the veterinary POC diagnostic market. Diagnostic tools are being employed to assess environmental factors that can impact animal health, such as water and soil quality. This trend reflects a holistic approach to veterinary care, considering both direct and indirect factors affecting animals.

Leave a Comment