Vertical Farming Size

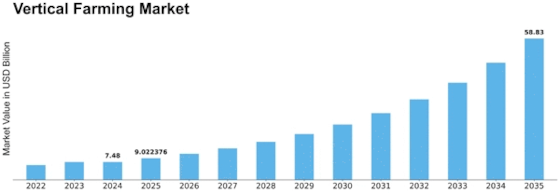

Vertical Farming Market Growth Projections and Opportunities

The rising need for food in tandem with the world's burgeoning population are two major factors affecting the vertical farming business. Standard farming isn’t enough to take care of the world's rising food needs since it requires too much space and is bad for the environment. Vertical farming has emerged as the new way to grow food. Most efficiently use space and resources by growing plants indoors in carefully controlled environments or stacked high. This makes vertical farming an alternative to the old ways of growing. People are learning more about how to protect the earth, which is another important growth reason. These ways of growing usually use too much water, hurt the land, and kill trees. Vertical farming, on the other hand, uses controlled environments that need less water and room, so it has less of an effect on the climate. More and more partners and buyers are worried about the damage that food production does to the earth. This method is a good fit for those people. Vertical farming could be a new way to feed everyone by the year 2050. Making a farm close to the people it serves will help keep natural resources safe and provide cheaper, healthy food that is free of disease. Normal farming and greenhouse farming aren't as green as vertical farming, which is known as the most cutting-edge way to farm. It saves a lot of space and water and leaves more room. Villages, hilly towns, and woods are all tough places to grow plants this way. People are moving to cities, worrying more about their health, and making more money each year, which is all good for the global vertical farming market. Companies that make medicines also use indoor farming to grow plants and veggies in a green space. A lot of drug companies grow different kinds of plants inside using techniques that are usually used to make biotech products. Plus, this tech lets more farms stay open, which helps the vertical farming business grow. Aeroponics, hydroponics, and smart farming systems are all new and very advanced ways to farm that help farms work better and grow more food. These tools make it very easy to control things like light, temperature, and humidity that happen in nature. Higher rates and shorter growth stages are possible because of this. It makes the business run more smoothly by lowering the cost of work and making sure that all crops are of the same quality. Many people still grow tomatoes, lettuce, cabbage, and veggies that you can eat this way. The food that grew the fastest was lettuce. This is because it can grow in small spaces with little extra care. First, it's important to make sure that vertical farming can grow the food in a way that makes money for the business. How long it takes for plants to grow fully is another thing to think about. Some plants, like mint and cabbage, grow quickly. It can be hard for many people to use vertical farms because they cost a lot to set up. But prices should go down as technology gets better and economies of scale kick in. With this, vertical farms will be able to make more money. There are also rules and awards from the government that have an impact on the vertical farming market. A lot of countries think that vertical farming could help them protect the earth and make sure they have enough food. Investors are more likely to put money into vertical farming projects when rules, funds, and grants support them. The government also controls and organizes the business to make sure that the food from vertical farms is safe and of good quality. Trends and consumer tastes are also things that affect the market. Vertical farming has become one of the most popular methods to grow food in light of the rising interest in healthier food that can be grown close to home. People are more interested in learning about from where their food comes and how they are grown. There is also interest in opting for farming that doesn’t hurt the environment and also enhances their health.

Leave a Comment