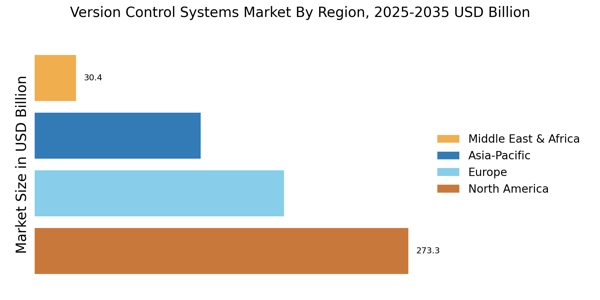

By RegionRegion, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. North America Version Control Systems market accounted for USD 231.79 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. Due to the significant presence of service providers like IBM, Microsoft, and Broadcom, the United States will eventually overtake Canada as North America's top market for version control systems. The rising demand for specialized version control systems across many industrial verticals is to blame.

Also, the nation's growing use of cell phones and the internet fuels industry expansion. Version Control Systems market players, both new and old, foresee significant growth potential due to the growing demand for mobile applications and the increasing need to handle several versions.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: VERSION CONTROL SYSTEMS MARKET SHARE BY REGION 2022 (%)

The need for software development services is growing across Europe. The European Version Control Systems market is forced to outsource operations due to a need for qualified software engineers. A big employment gap between available software engineers and open positions has plagued the Region region. Also, the numerous advantages of version control systems, like auditing, portability, and interoperability, are anticipated to stimulate market expansion. Also, the Region'sRegion's expanding development teams and rising need for project partnerships to quicken the product delivery processes are anticipated to promote growth.

Further, the German Version Control Systems market held the largest market share, and the UK Version Control Systems market was the fastest growing market in the European RegionRegion.

The greatest CAGR of 11.5% is anticipated for Asia Pacific Version Control Systems market throughout the projection period. Demand for version control systems will rise as interest in cutting-edge, secure cloud-based solutions increases. After this epidemic, there has been a rise in the need for digitalization in corporate operations worldwide. The demand for automation is expected to increase. Digital technology implementation is a top priority for businesses all around China as they prepare to resume operations through 2022 and beyond. Also, the use of version control systems in the BFSI and IT & telecom industries has steadily increased in India.

Moreover, China’s Version Control Systems market held the largest market share, and the Indian Version Control Systems market was the fastest-growing market in the Asia-Pacific region.