Adoption of Cloud-Based Solutions

The Vendor Management Software Market is experiencing a significant shift towards the adoption of cloud-based solutions. Organizations are increasingly favoring cloud technology due to its scalability, flexibility, and cost-effectiveness. Cloud-based vendor management software allows businesses to access their systems from anywhere, facilitating remote collaboration and real-time updates. This trend is particularly relevant as organizations seek to enhance their operational agility in a rapidly changing business environment. Data suggests that the adoption of cloud solutions in vendor management can lead to a 40% reduction in IT infrastructure costs. As more companies transition to cloud-based platforms, the Vendor Management Software Market is expected to expand, driven by the advantages offered by cloud technology.

Increased Focus on Supplier Diversity

The Vendor Management Software Market is also witnessing an increased focus on supplier diversity as organizations aim to foster inclusive procurement practices. Companies are recognizing the value of engaging diverse suppliers, which can lead to enhanced innovation and improved market competitiveness. This trend is particularly pronounced in sectors where corporate social responsibility is a priority. Vendor management software plays a crucial role in tracking and managing diverse suppliers, ensuring that organizations meet their diversity goals. As businesses strive to create more equitable supply chains, the demand for software that supports supplier diversity initiatives is likely to rise. This shift not only benefits the Vendor Management Software Market but also contributes to broader societal goals of inclusion and equity.

Emphasis on Data-Driven Decision Making

In the current landscape, the Vendor Management Software Market is witnessing a pronounced emphasis on data-driven decision making. Organizations are increasingly relying on analytics to assess vendor performance, manage risks, and make informed procurement choices. The integration of advanced analytics within vendor management software allows businesses to gain insights into vendor reliability, pricing trends, and service quality. This data-centric approach not only enhances decision-making but also fosters stronger vendor relationships. Reports indicate that companies utilizing data analytics in their vendor management processes experience a 25% improvement in vendor performance metrics. As the importance of data continues to grow, the Vendor Management Software Market is likely to expand, driven by the need for organizations to harness data for strategic advantage.

Growing Demand for Operational Efficiency

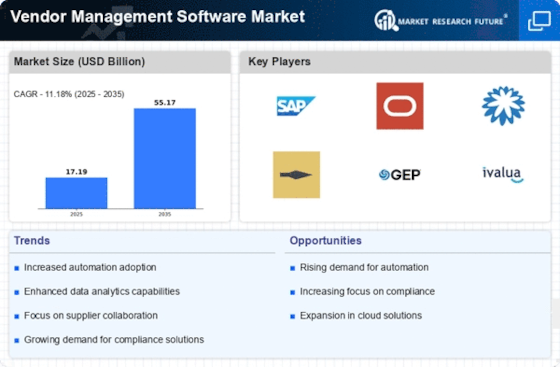

The Vendor Management Software Market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their vendor interactions and optimize procurement processes. This trend is driven by the desire to reduce costs and enhance productivity. According to recent data, companies utilizing vendor management software have reported up to a 30% reduction in procurement costs. As businesses strive to remain competitive, the adoption of such software becomes essential for maintaining operational excellence. The ability to automate vendor onboarding, performance tracking, and compliance management contributes significantly to this efficiency. Consequently, the Vendor Management Software Market is poised for growth as more organizations seek to leverage technology to improve their vendor relationships and overall operational workflows.

Rising Regulatory Compliance Requirements

The Vendor Management Software Market is significantly influenced by the rising regulatory compliance requirements across various sectors. Organizations are increasingly mandated to adhere to stringent regulations concerning vendor selection, performance monitoring, and risk management. This regulatory landscape compels businesses to adopt robust vendor management solutions that ensure compliance and mitigate risks. For instance, industries such as finance and healthcare face rigorous scrutiny, necessitating comprehensive vendor oversight. The demand for software that can facilitate compliance tracking and reporting is thus on the rise. As organizations strive to avoid penalties and reputational damage, the Vendor Management Software Market is expected to grow, driven by the need for effective compliance management solutions.