Top Industry Leaders in the Vehicle Electrification Market

The vehicle electrification market is thrumming with activity, fueled by surging demand for eco-friendly mobility solutions, tightening emission regulations, and technological advancements. This dynamism translates into a fiercely competitive landscape, where established automakers, tech giants, and startups vie for dominance.

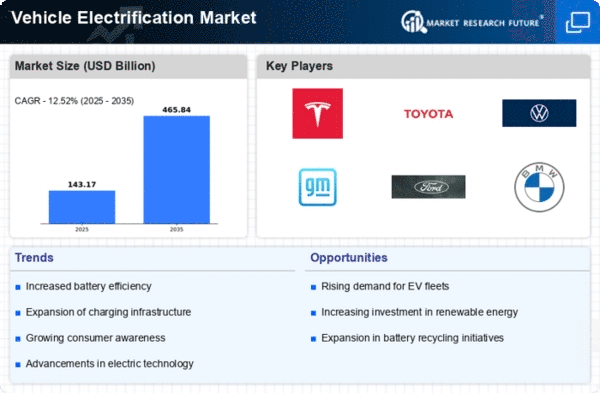

Key players like Tesla, Toyota, Volkswagen Group, General Motors, and BYD lead the charge with diverse strategies. Tesla, the EV pioneer, banks on its brand recognition, advanced battery technology, and self-driving aspirations. Toyota, a hybrid kingpin, balances its Prius legacy with investments in BEVs and fuel cell vehicles. Volkswagen Group, through its multi-brand approach, targets various segments with models like the iconic ID.3 and the Porsche Taycan. General Motors, with its Ultium platform, aims to scale production and affordability. BYD, a Chinese powerhouse, excels in both battery production and vehicle manufacturing, integrating vertically for a competitive edge.

Market share analysis in this evolving scene necessitates consideration of multiple factors. While traditional metrics like sales volume and revenue remain important, metrics like battery range, charging infrastructure access, and software advancements are gaining equal weight. Additionally, customer preferences across regions and vehicle segments demand attention. For instance, Europe's focus on compact EVs differs from the American preference for larger SUVs.

Emerging trends further shape the competitive landscape. Battery technology innovation is paramount, with players like Samsung SDI and LG Energy Solution vying for dominance in high-density, fast-charging batteries. Software capabilities are also critical, as advanced onboard systems and connectivity features become differentiators. The rise of autonomous driving technology adds another layer of complexity, with companies like Tesla and Waymo aiming for integration with their EVs.

Beyond established players, new entrants are stirring the pot. Startups like Rivian and Lucid Motors challenge premium segments with luxury electric offerings. Others, like Nikola and Hyzon Motors, focus on commercial vehicles, particularly fuel cell trucks. These disruptors bring fresh perspectives and agile adaptability, forcing established players to innovate and refine their strategies.

The overall competitive scenario paints a picture of intense rivalry, strategic partnerships, and constant evolution. Collaborations are on the rise, with automakers joining forces with battery manufacturers, technology giants, and even competitors to share resources and accelerate development. Consolidation through mergers and acquisitions is also likely, as companies seek to expand their reach and secure critical technologies.

Looking ahead, the competitive landscape will likely be shaped by government policies, global economic conditions, and the evolving energy infrastructure. Stringent emission regulations will continue to drive EV adoption, while rising energy costs may necessitate advancements in energy efficiency and renewable sources. The development of charging infrastructure, particularly fast-charging networks, will play a crucial role in consumer comfort and range anxiety alleviation.

In conclusion, the vehicle electrification market is a dynamic battleground teeming with established players, disruptive newcomers, and ever-evolving trends. Analyzing market share, understanding key strategies, and staying abreast of new developments will be crucial for any player hoping to navigate this electrifying race and secure a dominant position in the future of mobility.

Industry Developments and Latest Updates:

Robert Bosch GmbH (Germany):

- Date: December 15, 2023

- Source: Bosch Press Release

- Development: Bosch partners with Contemporary Amperex Technology Co., Ltd. (CATL) for the development and production of battery cells for electric vehicles.

Continental AG (Germany):

- Date: December 22, 2023

- Source: Reuters

- Development: Continental plans to invest €7 billion in electric vehicle technology over the next five years.

ZF Friedrichshafen AG (Germany):

- Date: December 19, 2023

- Source: ZF Press Release

- Development: ZF launches a new electric drive unit for commercial vehicles with an output of up to 300 kW.

Denso Corporation (Japan):

- Date: December 12, 2023

- Source: Nikkei Asian Review

- Development: Denso develops a new silicon carbide power module for electric vehicles that can reduce energy loss by up to 30%.

JTEKT Corporation (Japan):

- Date: December 7, 2023

- Source: JTEKT Press Release

- Development: JTEKT partners with REE Automotive to develop electric vehicle platforms for commercial vehicles.

Top Companies in the Vehicle Electrification industry includes,

Robert Bosch GmbH (Germany)

Continental AG (Germany)

ZF Friedrichshafen AG (Germany)

Denso Corporation (Japan)

JTEKT Corporation (Japan)

Nexteer Automotive (U.S.)

Mitsubishi Electric Corporation (Japan).

Mando Corp. (South Korea)

Borgwarner Inc. (U.S.)

Delphi Automotive PLC (U.K.)

Johnson Electric (Hong Kong), and others.