Market Analysis

In-depth Analysis of Vascular Patches Market Industry Landscape

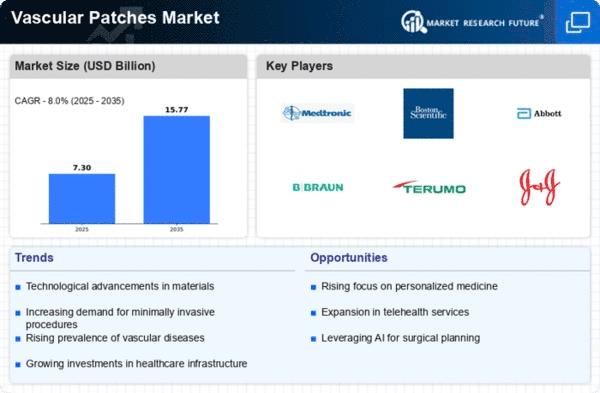

The vascular patches market has witnessed dynamic forces driving its growth and evolution. Vascular patches are used in various cardiovascular conditions where they play the role of repairing material during surgery. The industry thus operates under the influence of a complex combination of factors like advanced technology, high prevalence rates for vascular diseases and increasing ageing population. Technological innovation still remains among the key drivers for vascular patches’ future potential eventually determining its performance. Through continuous research and development (R&D), there have been better performing synthetic patches made from advanced materials that were used for repair.

The increasing prevalence of vascular diseases is another influential factor in market dynamics. The rise in global incidence of cardiovascular conditions due to an ageing population and lifestyle-related factors has led to a growing demand for vascular interventions that work. These medical devices continue to be of high importance in surgical operations like endarterectomy as well as vascular reconstruction hence the continued market demand. The market is responding to a changing healthcare landscape with an emphasis on minimally invasive procedures and innovative solutions for better patient outcomes.

Further influence on the market dynamics comes from regulatory frameworks and standards that control the production and distribution processes of these patches. Rigorous regulatory requirements protect both patients’ safety and efficiency, thus, defining competition by creating barriers for new entrants into this industry. Abiding by these regulations is important for companies seeking market shares in research, development, and commercialization. It is not only a requirement by the law but also about corporate reputation or status.

Market dynamics of vascular patches are driven by global economic factors. Market trends are shaped by economic growth, health care spending and reimbursement policies. Affordable healthcare services such as vascular surgeries depend on economic forces. Economic downturns affect healthcare budgets which in turn impact consumer affordability leading to changes in the market dynamics of vascular patches. Conversely, economies doing well with increased healthcare expenditure support expansion.

A major component within the landscape surrounding Vascular Patches is competition amongst firms supplying them; including dominant players’, rivals at regional level as well as new comers who always want to show innovation through their efficiency oriented activities. Mergers and acquisitions can be common when it comes to strategic alliances meant at strengthening any organization’s position vis-à-vis its competitor- even though it may involve widening ones portfolio through addition of new products or services.

Leave a Comment