Vacuum Pumps Size

Vacuum Pumps Market Growth Projections and Opportunities

Searching...

What is the projected market valuation of The Vacuum Pumps Market by 2035?

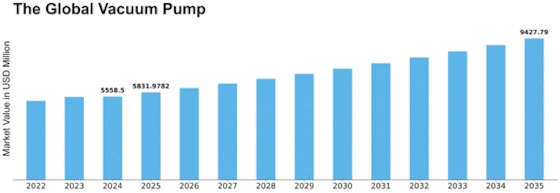

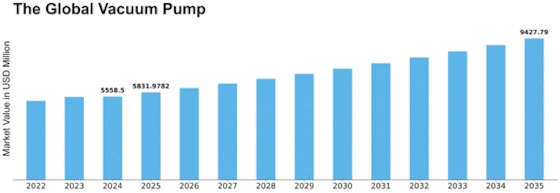

The projected market valuation of The Vacuum Pumps Market is 9427.79 USD Million by 2035.

What was the overall market valuation of The Vacuum Pumps Market in 2024?

The overall market valuation of The Vacuum Pumps Market was 5558.5 USD Million in 2024.

What is the expected CAGR for The Vacuum Pump during the forecast period 2025 - 2035?

The expected CAGR for The Vacuum Pump during the forecast period 2025 - 2035 is 4.92%.

Which companies are considered key players in The Vacuum Pump?

Key players in The Vacuum Pump include Edwards, Pfeiffer Vacuum, Leybold, Busch, Agilent Technologies, Gardner Denver, Atlas Copco, Kurt J. Lesker Company, and ULVAC.

What are the main segments of The Vacuum Pumps Market?

The main segments of The Vacuum Pumps Market include Mechanism, Pump Type, Lubrication, Pressure, End Use Industry, and Application Industry.

What was the valuation of the Gas Transfer segment in the Mechanism category in 2024?

The valuation of the Gas Transfer segment in the Mechanism category was 3339.25 USD Million in 2024.

As per Market Research Future analysis, The Global Vacuum Pumps Market Size was estimated at 5558.5 USD Million in 2024. The vacuum pump industry is projected to grow from 5831.99 USD Million in 2025 to 9427.79 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.9% during the forecast period 2025 - 2035

The Vacuum Pumps Market is poised for substantial growth driven by technological advancements and increasing demand across various sectors.

| 2024 Market Size | 5558.5 (USD Million) |

| 2035 Market Size | 9427.79 (USD Million) |

| CAGR (2025 - 2035) | 4.92% |

| Largest Regional Market Share in 2024 | Asia Pacific |

Edwards (GB), Pfeiffer Vacuum (DE), <a href="https://www.leybold.com/en-in/products/vacuum-pumps">Leybold </a>(DE), Busch (DE), Agilent Technologies (US), Gardner Denver (US), <a href="https://www.atlascopco.com/en-in/vacuum-solutions">Atlas Copco</a> (SE), Kurt J. Lesker Company (US), ULVAC (JP)

The Vacuum Pumps Market is currently experiencing a dynamic evolution, driven by advancements in technology and increasing demand across various sectors. Industries such as pharmaceuticals, food processing, and semiconductor manufacturing are increasingly relying on vacuum pumps for their operational efficiency and product quality. This reliance suggests a growing recognition of the importance of vacuum technology in enhancing production processes and ensuring compliance with stringent quality standards. Furthermore, the trend towards automation and smart manufacturing is likely to propel the adoption of advanced vacuum systems, which may offer enhanced performance and energy efficiency. In addition to technological advancements, environmental considerations are becoming more prominent within The Vacuum Pump. Manufacturers are increasingly focusing on developing eco-friendly solutions that minimize energy consumption and reduce emissions. This shift towards sustainability appears to be influencing purchasing decisions, as companies seek to align with global environmental goals. Moreover, the expansion of emerging markets is expected to create new opportunities for growth, as industries in these regions adopt vacuum technology to improve their operational capabilities. Overall, The High Pressure Pump is poised for continued growth, driven by innovation, sustainability, and the evolving needs of diverse industries.

The Vacuum Pumps Market is witnessing a surge in technological innovations, particularly in the development of energy-efficient and high-performance systems, especially across applications involving industrial vacuum pumps. These advancements are enabling industries to enhance productivity while reducing operational costs.

There is a growing emphasis on sustainability within The Vacuum Pump, as manufacturers strive to create eco-friendly products. This trend reflects a broader commitment to environmental responsibility and energy conservation.

The expansion of emerging markets is likely to drive demand for vacuum pumps, as industries in these regions increasingly adopt advanced technologies. This trend suggests a potential for significant market growth in the coming years.

Energy efficiency has emerged as a critical concern within The Vacuum Pumps Industry. As industries strive to reduce operational costs and minimize their carbon footprint, the demand for energy-efficient vacuum pumps is on the rise. Manufacturers are responding by developing pumps that consume less energy while maintaining high performance levels. This trend is particularly evident in sectors such as chemical processing and environmental applications, where energy costs can significantly impact overall expenses. The market for energy-efficient vacuum pumps, including advanced oil-sealed vacuum pumps, is expected to grow, driven by regulatory pressures and corporate sustainability initiatives. Furthermore, advancements in materials and design are likely to enhance the energy efficiency of vacuum systems, making them more attractive to end-users seeking to optimize their operations.

Emerging economies are increasingly becoming significant contributors to The Vacuum Pumps Industry. Countries in Asia-Pacific and Latin America are experiencing rapid industrialization, leading to heightened demand for Vacuum Pumps Market across various sectors, including food processing, packaging, and electronics. The market in these regions is anticipated to grow at a CAGR of around 6.5%, reflecting the increasing investments in infrastructure and manufacturing capabilities. Additionally, the expansion of the automotive and aerospace industries in these regions further propels the need for efficient vacuum systems. As these economies continue to develop, the demand for reliable and cost-effective vacuum solutions is likely to rise, presenting lucrative opportunities for manufacturers and suppliers in the industry.

The pharmaceutical sector is a key driver of growth in The Vacuum Pumps Market. With the increasing demand for pharmaceuticals and biopharmaceuticals, the need for reliable vacuum systems in processes such as freeze-drying, filtration, and distillation is becoming more pronounced. The market for vacuum pumps in this sector is projected to grow at a CAGR of approximately 7.0%, fueled by the rising investments in research and development. Additionally, stringent regulatory requirements for product quality and safety necessitate the use of advanced vacuum technologies. As pharmaceutical companies continue to innovate and expand their production capabilities, the demand for specialized vacuum pumps tailored to meet these needs is likely to increase, further bolstering the industry.

The evolution of vacuum pump technology plays a pivotal role in shaping The Vacuum Pumps Market. Innovations such as the development of dry vacuum pumps and oil-free systems have enhanced efficiency and reduced maintenance costs. These advancements cater to diverse applications, including semiconductor manufacturing and pharmaceuticals, where precision is paramount. The market is projected to witness a compound annual growth rate (CAGR) of approximately 5.2% over the next few years, driven by these technological improvements. Furthermore, the integration of smart technologies, such as IoT and automation, is likely to optimize performance and energy consumption, thereby attracting more industries to adopt advanced vacuum solutions. As a result, the demand for high-performance Vacuum Pumps Market is expected to surge, indicating a robust growth trajectory for the industry.

The semiconductor manufacturing sector is increasingly influencing The Vacuum Pumps Market. As the demand for electronic devices continues to rise, the need for vacuum pumps in processes such as chemical vapor deposition and etching is becoming critical. The market for vacuum pumps in this sector is expected to grow significantly, with a projected CAGR of around 8.0%. This growth is driven by the ongoing miniaturization of electronic components and the increasing complexity of semiconductor manufacturing processes. Furthermore, advancements in vacuum technology are enabling manufacturers to achieve higher levels of precision and efficiency, which are essential for producing cutting-edge semiconductor devices. As a result, the semiconductor industry is likely to remain a vital driver of growth for the vacuum pump market.

In The Vacuum Pump, the mechanism segment showcases a clear distribution of market share between gas transfer and gas binding technologies. Gas transfer mechanisms are the predominant segment, benefiting from established applications across various sectors including manufacturing, food processing, and pharmaceuticals. On the other hand, gas binding mechanisms, although lesser in market share, are rapidly gaining traction due to their innovative approaches in handling exhaust gases and enhancing efficiency in industrial operations, allowing for a dynamic shift in the market landscape.

Mechanism: Gas Transfer (Dominant) vs. Gas Binding (Emerging)

Gas transfer mechanisms, known for their ability to efficiently move and manage gases in various applications, dominate the market due to their reliability and performance in critical operations. These <a href="https://www.marketresearchfuture.com/reports/pumps-market-7423">pumps </a>are essential in applications requiring precise vacuum levels, such as thermal processing and chemical manufacturing. Conversely, gas binding mechanisms represent the emerging segment, characterized by their innovative designs catering to niche applications, especially in environmental control and energy efficiency. These pumps are designed to bind and manage gases more effectively, thus appealing to sectors focused on sustainability and regulatory compliance. As environmental concerns escalate, gas binding technology is set to become increasingly relevant.

The Vacuum Pump market is characterized by diverse segments, notably Positive Displacement and Dry Vacuum types. Positive Displacement pumps hold the largest market share, owing to their efficient performance and reliability in various industrial applications. In contrast, the Dry Vacuum segment is rapidly gaining traction, primarily driven by stringent environmental regulations and increased demand for energy-efficient solutions.

Pump Type: Positive Displacement (Dominant) vs. Dry Vacuum (Emerging)

Positive Displacement pumps are recognized for their ability to move a consistent volume of fluid, making them the go-to choice in industries requiring precise vacuum levels. Their reliable performance across chemical, pharmaceutical, and food processing sectors underpins their dominant market position. On the other hand, <a href="https://www.marketresearchfuture.com/reports/dry-vacuum-pump-market-28288">Dry Vacuum pumps</a> are emerging due to their eco-friendly design, eliminating the use of oils in the pumping process. This shift towards sustainable solutions is propelling their growth, particularly in sectors like semiconductor manufacturing, where contamination is critical.

In The Vacuum Pump market, the lubrication segment comprises two primary categories: dry vacuum and wet vacuum. Dry vacuum pumps hold a larger share of the market due to their efficiency, low maintenance requirements, and suitability for a wide range of applications. They are particularly favored in industrial settings where consistent performance is critical. Wet vacuum pumps, meanwhile, represent the fastest-growing category, gaining traction in applications requiring enhanced cooling and lubrication, especially in chemical and pharmaceutical industries. Their ability to handle vapor and humidity makes them increasingly popular in niche market segments.

Lubrication: Dry Vacuum (Dominant) vs. Wet Vacuum (Emerging)

Dry vacuum pumps are distinguished by their ability to operate without any lubricating fluids, allowing for cleaner processing and reduced environmental impact. They are predominantly used across industries such as semiconductor manufacturing, food processing, and packaging. Their high efficiency and reliability contribute to their dominant market presence. Conversely, wet vacuum pumps utilize liquid for lubrication and cooling, which enhances their performance under specific conditions. They are particularly suited for applications involving corrosive gases or vapors, making them an emerging choice in versatile sectors like pharmaceuticals and petrochemicals. As regulatory standards tighten, wet vacuum technology is expected to attract increased investments and innovation, further enhancing its market position.

The Vacuum Pump market is significantly characterized by the varying preferences for different pressure segments. Among these, Rough Vacuum Pumps hold the largest market share, primarily due to their widespread applications in industries like food packaging, chemical processing, and HVAC systems. In contrast, Ultra-High Vacuum Pumps are witnessing rapid growth owing to the increasing demand from sectors such as semiconductor manufacturing, research laboratories, and aerospace. As industries continue to evolve, the distribution of market share reflects the diverse needs across sectors. Growth trends in the vacuum pump market reveal that while Rough Vacuum Pumps maintain their dominance, the swift rise of Ultra-High Vacuum Pumps is a notable aspect of the evolving landscape. Technological advancements and stringent quality standards in electronics and pharmaceuticals are driving the demand for higher vacuum levels. These trends highlight a shifting focus and innovation in designing more efficient and durable vacuum pumps to meet emerging industrial needs, shaping the future of this segment.

Rough Vacuum Pumps (Dominant) vs. Ultra-High Vacuum Pumps (Emerging)

Rough Vacuum Pumps are the backbone of the vacuum pump market, characterized by their ability to create low vacuum levels suitable for various industrial applications. They are widely used in reshaping processes like casting and drying, making them essential for many manufacturing sectors. Their simplicity, reliability, and cost-effectiveness contribute to their dominant market position. On the other hand, Ultra-High Vacuum Pumps, though currently a smaller segment, are emerging due to advancements in technology and increasing demands for high-performance applications. They excel in providing superior vacuum levels necessary for cutting-edge processes in scientific research and medical equipment manufacturing. This aspiring segment is experiencing enhanced innovation, with manufacturers focusing on improving energy efficiency and performance to capture the growing market.

The Vacuum Pump market is primarily driven by several end-use industries, with Aerospace & Defense holding a significant market share. This sector utilizes vacuum pumps for various applications including material handling, thermal cycles, and production processes. Following closely is the Automotive industry that employs these pumps for evacuation and degassing processes, contributing substantially to market dynamics. Other noteworthy sectors include Chemical & Petrochemical, Electronics & Semiconductors, and Food & Beverage, all of which play crucial roles in the overall vacuum pump demand.

Aerospace & Defense (Dominant) vs. Healthcare & Pharmaceuticals (Emerging)

The Aerospace & Defense sector is recognized as a dominant force in The Vacuum Pump, largely due to its extensive use of advanced technologies that require precise vacuum systems for operations like testing and manufacturing of aerospace components. This sector demands high-performance vacuum pumps that ensure reliability and efficiency. In contrast, the Healthcare & Pharmaceuticals segment is emerging rapidly, propelled by advancements in medical technologies and increased focus on pharmaceutical manufacturing processes. This sector’s growth is fueled by a rising demand for sterile environments, which vacuum pumps help facilitate, illustrating their essential role in maintaining product safety and quality.

The application industry segment of The Vacuum Pump market is diverse, with significant distribution among various applications. Assembly processes represent the largest share, as vacuum pumps are integral in maintaining precise environmental conditions to ensure quality and efficiency. Conversely, engine testing is emerging as the fastest-growing application, fueled by advancements in technology and increasing demand for efficient testing mechanisms across automotive industries.

Application: Assembly (Dominant) vs. Engine Testing (Emerging)

Assembly processes dominate the vacuum pump market due to their essential role in ensuring product assembly under controlled environments. This segment benefits from industries such as electronics and automotive, where maintaining clean and precise conditions is crucial. On the other hand, engine testing is gaining traction, driven by the need for rigorous quality assurance and performance evaluation in modern engines. As manufacturers strive for higher performance standards and regulations tighten, vacuum pumps used in engine testing are expected to see substantial growth, positioning them as an emerging yet vital part of the market.

North America is the largest market for vacuum pumps, holding approximately 40% of the global share. The region's growth is driven by advancements in technology, increasing demand from the semiconductor and pharmaceutical industries, and stringent regulatory standards promoting efficiency. The U.S. is the primary contributor, followed by Canada, which is experiencing a rise in industrial applications requiring vacuum technology. The competitive landscape is characterized by the presence of major players such as Agilent Technologies, Edwards, and Gardner Denver. These companies are investing in R&D to innovate and enhance product offerings. The U.S. government’s support for manufacturing and technology development further bolsters market growth, ensuring a robust environment for vacuum pump applications across various sectors.

Europe is the second-largest market for vacuum pumps, accounting for around 30% of the global market share. The region benefits from a strong regulatory framework that encourages energy efficiency and environmental sustainability. Countries like Germany and France are leading the charge, with increasing investments in industrial automation and clean technologies driving demand for vacuum pumps. Germany stands out as a key player, hosting major manufacturers like Pfeiffer Vacuum and Leybold. The competitive landscape is marked by innovation and collaboration among companies to meet stringent EU regulations. The European market is also witnessing a shift towards eco-friendly vacuum solutions, aligning with the EU's Green Deal objectives, which aim to reduce carbon emissions and promote sustainable practices.

Asia-Pacific is witnessing rapid growth in the vacuum pump market, holding approximately 25% of the global share. The region's expansion is fueled by increasing industrialization, particularly in countries like China and India, where manufacturing and electronics sectors are booming. Government initiatives aimed at enhancing infrastructure and technology adoption are also significant growth drivers. China is the largest market in the region, with a strong presence of local manufacturers and international players like ULVAC and Atlas Copco. The competitive landscape is evolving, with companies focusing on innovation and cost-effective solutions to cater to diverse industrial needs. The growing emphasis on automation and smart manufacturing is expected to further boost the demand for vacuum pumps in the coming years.

The Middle East and Africa region is emerging as a significant market for vacuum pumps, holding about 5% of the global share. The growth is driven by increasing investments in oil and gas, mining, and manufacturing sectors. Countries like Saudi Arabia and South Africa are leading the market, with a focus on enhancing industrial capabilities and infrastructure development. The competitive landscape is characterized by a mix of local and international players, with companies exploring opportunities in various sectors. The region's potential is further supported by government initiatives aimed at diversifying economies and promoting industrial growth. As industries expand, the demand for efficient vacuum solutions is expected to rise, presenting opportunities for market players.

With a strong presence across different verticals and geographies, the Vacuum Pumps Market is highly competitive and dominated by established, pure-play vendors. Many vendors cater to this market, and they continually innovate their solutions to meet the evolving needs of businesses by adopting innovative technologies and innovations to make rapid lubrication filters more effective. These vendors have a robust geographic footprint and partner ecosystem to cater to diverse customer segments.

The Vacuum Pump Market is highly competitive, with many vendors offering similar products and services. The major players in the market include Atlas Copco AB, Pfeiffer Vacuum Technology AG, Ingersoll Rand, Agilent Technologies Inc., ULVAC Inc., Ebara Corporation, Leybold GmbH, Busch Vacuum Pumps Market and Systems, Shimadzu Corporation, Kashiyama Industries Ltd, KNF Neuberger GmbH, Gast Manufacturing Inc., Gebr. Becker GmbH, and PPI Pumps Pvt. Ltd. The Vacuum Pumps Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

In November 2023, Tesa SE, international manufacturer of innovative adhesive tapes and self-adhesive product solutions, is introducing another more sustainable tape. The new Tesa 51345 is a paper-based reinforcement adhesive tape that can be used, for example, to reinforce packaging or cartons at sensitive points such as side hole handles, flap handles, and top-hole handles. It is part of a comprehensive range for corrugated board manufacturers.

In October 2022, Avery Dennison Corporation announced a portfolio of interior surface bonding solutions for the building and construction segment. The Avery Dennison Interior Surfaces portfolio offers nine pressure-sensitive tape constructions featuring a variety of adhesive technologies applicable for bonding materials to commercial and residential interior surfaces.

In May 2023, Henkel opened its Technology Centre in Bridgewater, New Jersey, US. Occupying 70,000 square ft., the center provides a unique and interactive destination for the company’s strategic partners and customers. The facility showcases Henkel’s entire technology portfolio of adhesives, sealants, functional coatings, and specialty materials and supports an environment for collaboration with customers from over 800 industry segments to develop innovative solutions.

February 2024- Elgi Equipment disclosed the latest partnership. The organization has collaborated with Italy's D.V.P. Vacuum Technology S.p.A. to generate, assemble, test, and market D.V.P.'s special vacuum products in India. The partnership allows ELGi to expand its product range to include vacuum products. Elgi Equipment Limited offers a thorough variety of compressed air solutions, embracing oil-lubricated and oil-free rotary screw compressors, centrifugal compressors, reciprocating compressors, filters, dryers, and several downstream accessories. With a varied portfolio surpassing 400 products, ELGi's solutions serve a wide range of industries. For nearly fifty years, D.V.P.

Vacuum Technology has been a significant figure in the vacuum technology field.

Their selection of vacuum pumps and compressors caters to several industries, such as packaging, medical, food and beverage, chemicals, and wood, stone, and glass processing. Placed in San Pietro in Casale, Italy, D.V.P. also has branches in the United States and Brazil. D.V.P. Vacuum Technology S.p.A., famous for its vacuum pumps, stands to profit from ELGi's robust production capabilities and extensive sales and service network in India, enabling them to tap into the quickly growing Indian market. Over the last few years, the

vacuum pump market has witnessed constant development and is anticipated to acquire a value of 6-7 billion USD by 2024. The Managing Director of ELGi Equipments Ltd., Dr. Jairam Varadaraj, said that at first, the company would concentrate on founding the business in India before growing across the globe. The company is happy to partner with D.V.P. Vacuum Technology, a family-owned company with a prolonged history in the vacuum industry since 1973. The group at D.V.P. shares its core values, and its products are famous for their performance and quality.

The Vacuum Pumps Market is projected to grow at a 4.92% CAGR from 2025 to 2035, driven by advancements in technology, increasing industrial automation, and rising demand in healthcare applications.

New opportunities lie in:

By 2035, the Vacuum Pumps Market is expected to achieve robust growth, driven by innovation and strategic investments.

| MARKET SIZE 2024 | 5558.5(USD Million) |

| MARKET SIZE 2025 | 5831.99(USD Million) |

| MARKET SIZE 2035 | 9427.79(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 4.92% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Million |

| Key Companies Profiled | Edwards (GB), Pfeiffer Vacuum (DE), Leybold (DE), Busch (DE), Agilent Technologies (US), Gardner Denver (US), Atlas Copco (SE), Kurt J. Lesker Company (US), ULVAC (JP) |

| Segments Covered | mechanism, pump type, lubrication, pressure, end use, application, region –Market Forecast Till 2035 |

| Key Market Opportunities | Integration of advanced automation technologies enhances efficiency in The Global Vacuum Pump. |

| Key Market Dynamics | Technological advancements drive efficiency improvements and competitive dynamics in the vacuum pump market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

What is the projected market valuation of The Vacuum Pumps Market by 2035?

The projected market valuation of The Vacuum Pumps Market is 9427.79 USD Million by 2035.

What was the overall market valuation of The Vacuum Pumps Market in 2024?

The overall market valuation of The Vacuum Pumps Market was 5558.5 USD Million in 2024.

What is the expected CAGR for The Vacuum Pump during the forecast period 2025 - 2035?

The expected CAGR for The Vacuum Pump during the forecast period 2025 - 2035 is 4.92%.

Which companies are considered key players in The Vacuum Pump?

Key players in The Vacuum Pump include Edwards, Pfeiffer Vacuum, Leybold, Busch, Agilent Technologies, Gardner Denver, Atlas Copco, Kurt J. Lesker Company, and ULVAC.

What are the main segments of The Vacuum Pumps Market?

The main segments of The Vacuum Pumps Market include Mechanism, Pump Type, Lubrication, Pressure, End Use Industry, and Application Industry.

What was the valuation of the Gas Transfer segment in the Mechanism category in 2024?

The valuation of the Gas Transfer segment in the Mechanism category was 3339.25 USD Million in 2024.

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment