Uveitis Treatment Size

Market Size Snapshot

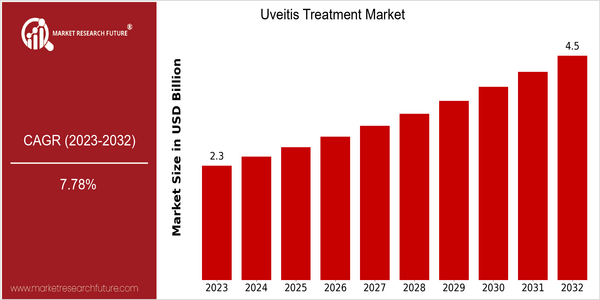

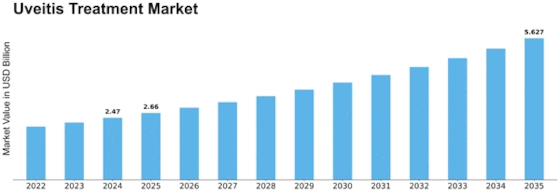

| Year | Value |

|---|---|

| 2023 | USD 2.29 Billion |

| 2032 | USD 4.5 Billion |

| CAGR (2024-2032) | 7.78 % |

Note – Market size depicts the revenue generated over the financial year

The uveitis treatment market is expected to reach approximately $2.29 billion by 2023, growing at a CAGR of 7.78% from 2024 to 2032. This growth rate indicates a significant increase in the demand for effective treatments for uveitis, which can lead to severe vision loss if left untreated. The market’s expansion is being driven by several factors, including the rising prevalence of autoimmune diseases, the development of new biological therapies, and the general public’s increased awareness of eye health. In addition, the growing research and development spending by pharmaceutical companies is spurring innovation in treatment modalities, which is further increasing the market’s growth. Uveitis treatment market leaders, including Novartis, AbbVie, and Regeneron, are engaging in strategic initiatives, such as collaborations and product launches, to enhance their market presence and address unmet medical needs. The introduction of new therapies that target specific inflammatory pathways, for example, has shown promise in improving patient outcomes and, consequently, in expanding the market.

Regional Market Size

Regional Deep Dive

The Uveitis Treatment Market is characterized by a growing demand for new therapies and a rising prevalence of uveitis in different regions. The market in North America is characterized by a high level of health care, a high level of awareness, and significant research and development investments. Europe is characterized by a strong regulatory framework and a focus on individualized therapies. The Asia-Pacific region is characterized by rapid growth due to the increasing availability of health care and the rising prevalence of autoimmune diseases. Middle East and Africa face unique challenges, such as limited access to health care, but are gradually increasing access to treatment. Latin America is experiencing a strong demand for cost-effective treatment options due to economic and health care reforms.

Europe

- The European Medicines Agency (EMA) has streamlined the approval process for uveitis treatments, encouraging pharmaceutical companies to invest in research and development.

- Collaborative projects between universities and biotech firms, such as those in Germany and France, are focusing on gene therapy and novel drug delivery systems, which are anticipated to revolutionize treatment approaches in the region.

Asia Pacific

- Countries like Japan and Australia are witnessing a rise in clinical trials for uveitis treatments, with local companies like Santen Pharmaceutical leading the way in developing targeted therapies.

- The increasing prevalence of autoimmune diseases in the region is prompting governments to invest in healthcare infrastructure, which is expected to improve access to uveitis treatments.

Latin America

- The Brazilian government has launched initiatives to improve access to healthcare, including uveitis treatments, which is expected to increase patient enrollment in treatment programs.

- Local pharmaceutical companies are focusing on developing cost-effective treatment options to cater to the growing demand in the region, driven by economic constraints faced by patients.

North America

- The FDA has recently approved several new biologic therapies for uveitis, enhancing treatment options and improving patient outcomes. Companies like AbbVie and Novartis are leading the charge with innovative products.

- Increased awareness campaigns by organizations such as the American Uveitis Society are helping to educate both healthcare providers and patients about the importance of early diagnosis and treatment, which is expected to drive market growth.

Middle East And Africa

- The establishment of specialized eye care centers in countries like South Africa is improving access to uveitis treatments, addressing a significant gap in healthcare services.

- International NGOs are collaborating with local governments to provide training for healthcare professionals, which is expected to enhance diagnosis and treatment capabilities in underserved areas.

Did You Know?

“Uveitis is responsible for approximately 10-15% of cases of blindness in developed countries, highlighting the critical need for effective treatment options.” — American Academy of Ophthalmology

Segmental Market Size

Uveitis treatment is currently a growing field of research. Uveitis is a disease of the eye, which is being increasingly recognized. There are several reasons for this. One of them is the growing number of autoimmune diseases, which often lead to uveitis. The market also benefits from the support of regulatory authorities for innovation, as can be seen from recent approvals by the FDA for new treatment modalities. The development stage of uveitis treatment is currently in the mature phase. Novartis and AbbVie are the market leaders with their established products, such as Iluvien and Humira. Their main applications are the treatment of chronic uveitis and associated complications, especially in regions with a high prevalence of autoimmune diseases, such as North America and Europe. The development of the market is facilitated by the increasing importance of personalized medicine and the use of telemedicine for patient monitoring. Gene therapy and new imaging techniques are also expected to play a role in the future of uveitis treatment. They will improve the accuracy of diagnosis and the effectiveness of treatment.

Future Outlook

The uveitis market is expected to grow at a CAGR of 7.78% between 2023 and 2032, from $2.29 billion to $ 4.50 billion. This growth is driven by an increase in the prevalence of uveitis, advances in treatment methods, and an increase in awareness of the disease among health care professionals and patients. The aging of the world population and the rising number of autoimmune diseases are expected to increase the demand for effective uveitis treatments, which will increase the penetration rate of these treatments in emerging economies where access to health care is increasing. And the development of new therapies, such as biologicals and targeted therapies, is expected to revolutionize the treatment of uveitis. In addition, innovations in drug delivery systems and personalized medicine are expected to improve the effectiveness of treatment and patient compliance, which will drive market growth. Supportive health care policies and increased funding for ophthalmic research will also facilitate the introduction of new therapies. The use of telemedicine and digital health solutions will also play a critical role in improving patient management and follow-up care, thereby improving the overall effectiveness of treatments. Taking all these factors into account, the uveitis market is expected to grow significantly, bringing new opportunities for all market players.

Leave a Comment