Automotive Industry Growth

The automotive industry is a significant driver of the Coated Steel Market, as manufacturers increasingly utilize coated steel for vehicle production. The demand for lightweight and corrosion-resistant materials is on the rise, driven by the need for fuel efficiency and sustainability in automotive design. In 2025, the coated steel market within the automotive sector is expected to grow by approximately 9%, reflecting the industry's shift towards advanced materials. Additionally, the trend towards electric vehicles is likely to further enhance the demand for coated steel, as manufacturers seek materials that contribute to overall vehicle performance. As the automotive industry evolves, the coated steel market is positioned to benefit from these trends, potentially leading to increased collaboration between steel producers and automotive manufacturers.

Infrastructure Development

Infrastructure development remains a pivotal driver for the Coated Steel Market. Governments worldwide are investing heavily in infrastructure projects, including roads, bridges, and buildings, which require durable and reliable materials. Coated steel, known for its strength and corrosion resistance, is increasingly favored in these applications. In 2025, the infrastructure sector is projected to account for a substantial share of the coated steel market, with an estimated growth rate of 8%. This growth is largely attributed to the ongoing urbanization trends and the need for modernized infrastructure to support economic growth. As countries prioritize infrastructure development, the demand for coated steel is likely to rise, presenting opportunities for manufacturers to innovate and expand their product offerings to meet the specific requirements of these projects.

Sustainability Initiatives

The Coated Steel Market is experiencing a notable shift towards sustainability initiatives. Manufacturers are increasingly adopting eco-friendly practices, such as using water-based coatings and recyclable materials. This trend is driven by growing consumer awareness and regulatory pressures aimed at reducing environmental impact. In 2025, the demand for sustainable coated steel products is projected to rise, with an estimated increase of 15% in market share attributed to green building practices. Furthermore, the construction sector is increasingly prioritizing sustainable materials, which is likely to bolster the coated steel market. As industries strive to meet sustainability goals, the coated steel market is positioned to benefit from these initiatives, potentially leading to enhanced product offerings and increased competitiveness.

Technological Advancements

Technological advancements play a crucial role in shaping the Coated Steel Market. Innovations in coating technologies, such as advanced polymer coatings and nanotechnology, are enhancing the performance and durability of coated steel products. These advancements not only improve corrosion resistance but also extend the lifespan of coated steel applications in various sectors, including automotive and construction. In 2025, the market is expected to witness a growth rate of approximately 10%, driven by the introduction of high-performance coatings that meet stringent industry standards. Additionally, automation in manufacturing processes is likely to increase efficiency and reduce production costs, further propelling the coated steel market forward. As technology continues to evolve, the industry may see a shift towards more specialized and high-value coated steel products.

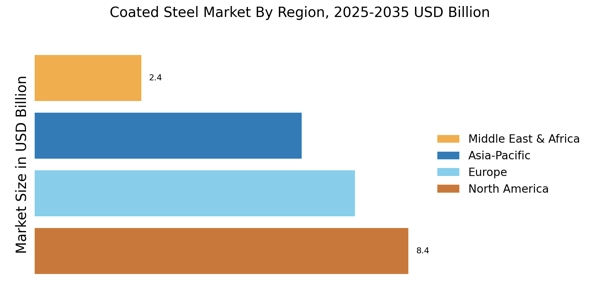

Rising Demand in Emerging Markets

The Coated Steel Market is witnessing a surge in demand from emerging markets, particularly in Asia and Africa. Rapid urbanization and industrialization in these regions are driving the need for coated steel in construction, infrastructure, and automotive applications. In 2025, it is anticipated that the coated steel market in emerging economies will grow by approximately 12%, reflecting the increasing investments in infrastructure development. Governments in these regions are implementing policies to boost manufacturing and construction activities, which is likely to further stimulate demand for coated steel products. This trend presents significant opportunities for manufacturers to expand their market presence and cater to the evolving needs of these burgeoning economies. As a result, the coated steel market is expected to experience robust growth fueled by the rising demand in these regions.