Us Zeolite Size

US Zeolite Market Growth Projections and Opportunities

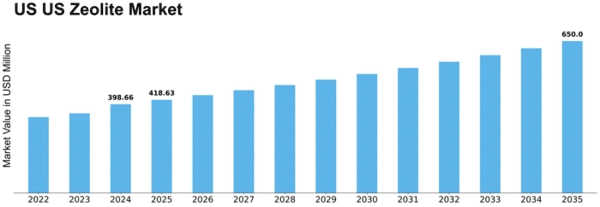

The US Zeolite Market is influenced by a variety of market factors that collectively contribute to its growth and dynamics. One of the primary drivers is the widespread applications of zeolites across multiple industries. Zeolites, natural or synthetic aluminosilicate minerals with a unique porous structure, find extensive use in water treatment, petrochemical refining, detergents, agriculture, and various environmental applications. The versatility of zeolites in adsorption, ion exchange, and catalysis makes them indispensable in addressing challenges related to water purification, air quality, and industrial processes, thereby driving the demand for zeolite products in the US market. US Zeolite Market Size was valued at USD 0.6 Billion in 2022. The zeolite industry is projected to grow from USD 0.64 Billion in 2023 to USD 0.913 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.50%

Moreover, environmental considerations and the growing awareness of sustainable practices play a significant role in shaping the US Zeolite Market. Zeolites are recognized for their eco-friendly characteristics, particularly in water treatment and air purification applications. The ability of zeolites to selectively adsorb pollutants and contaminants aligns with the increasing emphasis on sustainable solutions to address environmental challenges. As industries and municipalities strive to meet stringent environmental regulations, the demand for zeolites as a sustainable and effective solution continues to grow.

The agriculture sector's reliance on zeolites as soil amendments and animal feed additives contributes to market dynamics. Zeolites enhance soil fertility by improving water retention and nutrient availability, leading to increased agricultural productivity. In animal husbandry, zeolites are used to reduce ammonia levels in animal waste, contributing to environmental sustainability and animal welfare. The integration of zeolites in agriculture aligns with the broader trend towards sustainable and efficient farming practices.

Government policies and regulations related to environmental protection and water quality impact the US Zeolite Market. Stricter regulations governing industrial emissions, water discharge standards, and the use of certain chemicals in consumer products drive the adoption of zeolites as a compliant and effective solution. The regulatory landscape influences the choices made by industries and municipalities, creating opportunities for zeolite manufacturers to provide solutions that meet environmental standards.

Technological advancements in zeolite production processes contribute to market evolution. Innovations in synthesis techniques and modifications of zeolite properties enhance their performance and expand their applicability. The development of tailored zeolite products with specific characteristics for diverse applications allows manufacturers to meet the unique requirements of different industries, fostering innovation and differentiation in the market.

Market competition and industry collaborations are notable factors shaping the US Zeolite Market. The market features both domestic and international players, creating a competitive landscape. Collaboration between zeolite producers, researchers, and end-users facilitates the development of specialized products and applications. Partnerships between industry participants contribute to the overall growth and maturity of the zeolite market by leveraging collective expertise and market insights.

The oil and gas industry's reliance on zeolites for catalytic cracking and hydroprocessing activities influences market dynamics. Zeolite catalysts play a crucial role in refining processes, contributing to the production of high-quality fuels and petrochemical products. As the oil and gas industry undergoes technological advancements and seeks solutions for cleaner and more efficient processes, the demand for zeolites in catalytic applications remains substantial.

Global economic conditions and trade dynamics impact the zeolite market. Zeolites are traded globally, and factors such as tariffs, trade agreements, and geopolitical events can influence the supply chain and market conditions for zeolite products in the US. Economic stability and trade policies play a role in determining the accessibility of zeolite materials and their cost in the US market.

Leave a Comment