Innovation in Food Processing Techniques

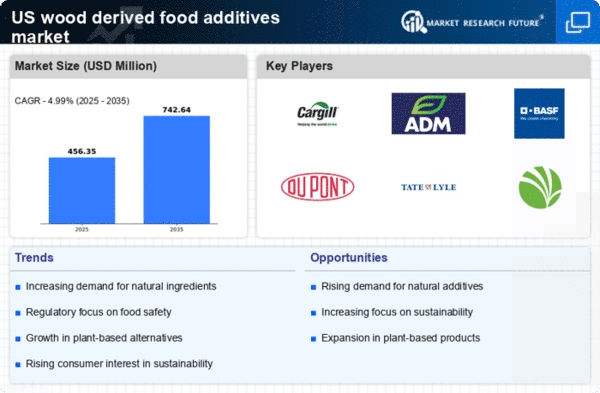

The wood derived-food-additives market is benefiting from ongoing innovations in food processing techniques. Advances in extraction and formulation methods are enhancing the efficiency and effectiveness of wood derived additives, making them more appealing to food manufacturers. For instance, new technologies allow for the extraction of high-quality compounds from wood, which can be utilized as flavor enhancers or preservatives. This innovation is crucial, as it enables manufacturers to meet the rising demand for natural ingredients while maintaining product quality. The market is projected to grow at a CAGR of 5% over the next five years, driven by these technological advancements. The wood derived-food-additives market must continue to invest in research and development to leverage these innovations and cater to evolving consumer preferences.

Sustainability and Environmental Concerns

Sustainability is becoming a pivotal driver in the wood derived-food-additives market. As environmental concerns escalate, consumers and businesses alike are seeking sustainable sourcing practices. Wood derived additives are often viewed as more environmentally friendly compared to synthetic alternatives, as they are biodegradable and sourced from renewable resources. The market is witnessing a shift towards sustainable practices, with a reported 60% of consumers willing to pay a premium for products that are sustainably sourced. This inclination towards sustainability is likely to influence purchasing decisions, thereby driving the growth of the wood derived-food-additives market. Companies that prioritize sustainable practices in their production processes may gain a competitive edge, appealing to eco-conscious consumers and contributing to the overall expansion of the market.

Rising Health Consciousness Among Consumers

Health consciousness is a significant driver in the wood derived-food-additives market. As consumers become more aware of the impact of food additives on their health, there is a growing demand for natural and safe alternatives. Wood derived additives are often perceived as healthier options, free from synthetic chemicals and artificial preservatives. This shift in consumer mindset is reflected in market trends, with a reported 55% of consumers actively seeking products that contain natural additives. The wood derived-food-additives market is likely to benefit from this trend, as manufacturers respond by reformulating products to include wood derived ingredients. This alignment with health-conscious consumer preferences is expected to foster growth and innovation within the market.

Consumer Preference for Clean Label Products

The wood derived-food-additives market is experiencing a notable shift as consumers increasingly favor clean label products. This trend is driven by a growing awareness of health and wellness, prompting consumers to scrutinize ingredient lists. As a result, manufacturers are compelled to incorporate natural additives derived from wood sources, which are perceived as healthier alternatives. According to recent data, approximately 70% of consumers in the US express a preference for products with minimal and recognizable ingredients. This consumer behavior is likely to propel the demand for wood derived-food additives, as they align with the clean label movement, thereby enhancing market growth. The wood derived-food-additives market must adapt to these changing preferences to remain competitive and relevant in a landscape that prioritizes transparency and health consciousness.

Regulatory Framework Favoring Natural Additives

The regulatory landscape is increasingly supportive of natural additives, which is positively impacting the wood derived-food-additives market. Regulatory bodies in the US are promoting the use of natural ingredients in food products, recognizing their potential health benefits. This regulatory support is likely to encourage manufacturers to incorporate wood derived additives into their formulations, as compliance with regulations becomes more favorable. Recent changes in food safety regulations have also streamlined the approval process for natural additives, making it easier for companies to bring wood derived products to market. As a result, the wood derived-food-additives market is expected to expand, with more manufacturers exploring the potential of natural ingredients to meet consumer demand and regulatory requirements.