Rising Security Concerns

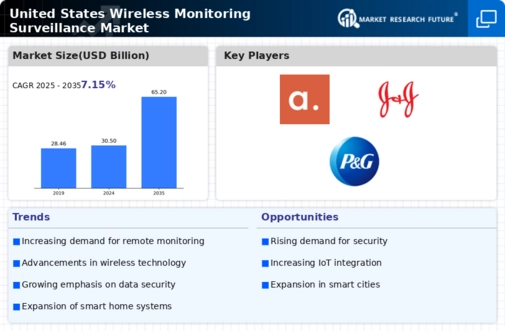

The increasing prevalence of security threats, including theft, vandalism, and cyber-attacks, drives demand for advanced surveillance solutions. In the wireless monitoring-surveillance market, businesses and homeowners are investing in sophisticated systems to enhance security measures. According to recent data, the market is projected to grow at a CAGR of 10.5% from 2025 to 2030, reflecting a heightened focus on safety. This trend is particularly evident in urban areas, where crime rates are higher, prompting the installation of wireless surveillance systems. The ability to monitor premises remotely through mobile devices further fuels this growth, as users seek real-time alerts and video feeds. Consequently, the wireless monitoring-surveillance market is positioned to expand significantly as security concerns continue to escalate.

Technological Advancements

Rapid advancements in technology are reshaping the wireless monitoring-surveillance market. Innovations such as high-definition cameras, improved wireless connectivity, and enhanced data storage solutions are making surveillance systems more effective and user-friendly. The integration of smart technologies, including IoT devices, allows for seamless connectivity and control over surveillance systems. As of 2025, the market is witnessing a shift towards more sophisticated solutions, with an estimated 40% of new installations incorporating AI-driven analytics. These advancements not only improve the quality of surveillance but also reduce operational costs, making them attractive to both residential and commercial users. The continuous evolution of technology is likely to drive further growth in the wireless monitoring-surveillance market.

Regulatory Compliance and Standards

The wireless monitoring-surveillance market is significantly influenced by regulatory compliance and standards set by government bodies. As privacy concerns grow, regulations surrounding data protection and surveillance practices are becoming more stringent. In the US, laws such as the California Consumer Privacy Act (CCPA) and various state-level regulations are shaping how surveillance systems are deployed and managed. Companies are increasingly required to ensure that their monitoring practices comply with these regulations, which may involve investing in more secure and transparent systems. This compliance not only protects consumer rights but also enhances the credibility of businesses in the wireless monitoring-surveillance market. As a result, adherence to regulatory standards is likely to drive innovation and investment in compliant surveillance solutions.

Expansion of Smart Home Technologies

The proliferation of smart home technologies is significantly impacting the wireless monitoring-surveillance market. As consumers increasingly adopt smart devices, the integration of surveillance systems with home automation is becoming commonplace. This trend is driven by the desire for enhanced convenience and security, as users can control their surveillance systems alongside other smart devices. In 2025, it is estimated that nearly 50% of new surveillance systems will be compatible with smart home platforms. This compatibility not only improves user experience but also encourages the adoption of wireless monitoring solutions. The expansion of smart home technologies is likely to continue influencing the wireless monitoring-surveillance market, as consumers seek comprehensive security solutions that integrate seamlessly with their lifestyles.

Increased Demand for Remote Monitoring

The demand for remote monitoring solutions is surging within the wireless monitoring-surveillance market. As more individuals and businesses seek flexibility and convenience, the ability to monitor properties from anywhere using mobile devices is becoming essential. This trend is particularly pronounced in the commercial sector, where businesses are looking to safeguard assets and ensure operational continuity. Recent statistics indicate that approximately 60% of new surveillance installations in 2025 are equipped with remote access capabilities. This shift not only enhances security but also allows for efficient management of resources. The growing reliance on remote monitoring solutions is expected to propel the wireless monitoring-surveillance market forward, as users prioritize accessibility and control.