Growing Mobile Workforce

The wireless data-communication market is benefiting from the growing mobile workforce in the United States. As more employees work remotely or in flexible environments, the demand for reliable wireless communication solutions has intensified. Companies are increasingly investing in mobile technologies to ensure that their workforce remains connected and productive, regardless of location. This shift is reflected in the projected growth of mobile data traffic, which is expected to increase by 40% annually. Consequently, service providers are focusing on enhancing their wireless networks to accommodate this growing demand, thereby driving innovation and expansion within the wireless data-communication market.

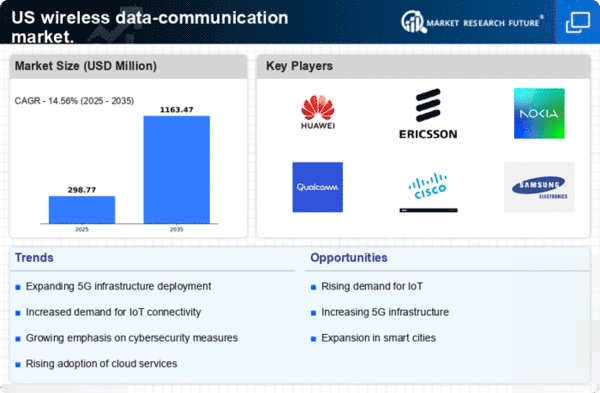

Expansion of Smart City Initiatives

The wireless data-communication market is being propelled by the expansion of smart city initiatives across the United States. Municipalities are increasingly investing in smart infrastructure to enhance urban living, which includes the deployment of connected devices and sensors. This trend is expected to create a substantial demand for wireless communication solutions, as these technologies facilitate real-time data exchange and improve city management. Reports indicate that investments in smart city projects could reach $100 billion by 2025, significantly impacting the wireless data-communication market. As cities adopt these technologies, the need for reliable and efficient wireless communication systems will become even more critical.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is significantly influencing the wireless data-communication market. These technologies enable more efficient data management and network optimization, enhancing overall performance. For instance, AI-driven analytics can predict network congestion and optimize resource allocation, thereby improving user experience. Furthermore, the adoption of these technologies is expected to increase operational efficiency by up to 30%, allowing service providers to offer more reliable and faster services. As a result, the wireless data-communication market is likely to witness a transformation in service delivery, driven by the capabilities of AI and ML.

Rising Demand for High-Speed Connectivity

The wireless data-communication market is experiencing a notable surge in demand for high-speed connectivity. As consumers and businesses increasingly rely on seamless internet access for various applications, the need for faster data transmission becomes paramount. This trend is particularly evident in urban areas, where the proliferation of smart devices and applications necessitates robust wireless infrastructure. According to recent data, the demand for high-speed internet services is projected to grow by approximately 25% annually, driving investments in advanced wireless technologies. Consequently, service providers are compelled to enhance their offerings, leading to a competitive landscape that fosters innovation and improved service quality in the wireless data-communication market.

Regulatory Support for Wireless Innovations

Regulatory support for wireless innovations is playing a crucial role in shaping the wireless data-communication market. Government initiatives aimed at promoting the development and deployment of advanced wireless technologies are fostering a conducive environment for growth. For instance, policies that facilitate spectrum allocation and encourage investment in infrastructure are likely to enhance the capabilities of wireless networks. This regulatory framework is expected to attract significant investments, with estimates suggesting that the market could see an influx of $50 billion in funding over the next five years. As a result, the wireless data-communication market is poised for substantial advancements, driven by supportive regulatory measures.