Rising Demand for Renewable Energy

The wind tower market is experiencing a notable surge in demand driven by the increasing emphasis on renewable energy sources. As the U.S. government sets ambitious targets for reducing greenhouse gas emissions, the wind energy sector is poised for growth. In 2025, wind energy accounts for approximately 9% of the total electricity generation in the U.S., reflecting a growing preference for sustainable energy solutions. This shift is likely to propel investments in wind tower infrastructure, as utilities and private developers seek to expand their renewable portfolios. The wind tower market is thus positioned to benefit from this rising demand, as more states implement policies to support clean energy initiatives.

Corporate Sustainability Initiatives

The growing trend of corporate sustainability initiatives is significantly impacting the wind tower market. Many companies are committing to ambitious sustainability goals, including achieving net-zero emissions. This has led to increased investments in renewable energy projects, particularly in wind energy. In 2025, it is estimated that over 50% of Fortune 500 companies have set renewable energy targets, which in turn drives demand for wind towers. The wind tower market is likely to benefit from these corporate commitments, as businesses seek to procure clean energy solutions to meet their sustainability objectives. This trend not only enhances market growth but also fosters partnerships between corporations and wind energy developers.

State-Level Renewable Energy Mandates

State-level renewable energy mandates are playing a crucial role in shaping the wind tower market. Many states have enacted laws requiring utilities to source a specific % of their energy from renewable sources, with wind energy being a primary focus. For example, California mandates that 60% of its electricity must come from renewable sources by 2030, which directly influences the demand for wind towers. This regulatory environment encourages investments in wind energy projects, thereby bolstering the wind tower market. As states continue to adopt and enforce such mandates, the market is expected to expand, driven by the need for new installations and upgrades to existing infrastructure.

Increased Investment in Infrastructure

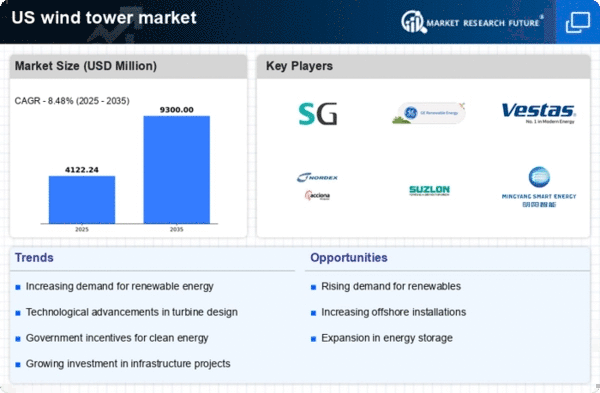

Investment in infrastructure is a key driver for the wind tower market, as the U.S. continues to modernize its energy grid. The Biden administration has proposed significant funding for renewable energy projects, including wind energy, as part of its infrastructure plan. This investment is expected to reach $100 billion over the next decade, facilitating the construction of new wind farms and the upgrading of existing facilities. The wind tower market stands to gain from this influx of capital, as it will likely lead to increased demand for wind towers and related components. As infrastructure improvements progress, the market is poised for substantial growth, driven by enhanced capacity and efficiency.

Advancements in Wind Turbine Technology

Technological innovations in wind turbine design and efficiency are significantly impacting the wind tower market. Enhanced turbine performance, including larger rotor diameters and improved materials, has led to increased energy output and reduced costs. For instance, the average capacity of newly installed wind turbines in the U.S. has risen to over 2.5 MW, which is indicative of advancements in turbine technology. These improvements not only enhance the viability of wind energy but also stimulate the wind tower market by necessitating the development of taller and more robust towers to support these larger turbines. As technology continues to evolve, the market is likely to see further enhancements that could drive growth.