Increased Focus on Fuel Efficiency

The growing emphasis on fuel efficiency in the automotive sector is another key driver for the wheel speed-sensor market. As consumers become more environmentally conscious and fuel prices fluctuate, manufacturers are compelled to enhance the fuel efficiency of their vehicles. Wheel speed sensors play a crucial role in optimizing engine performance and improving fuel economy by providing accurate data for various vehicle systems. In the US, the market for fuel-efficient vehicles is projected to grow by 10% annually, which may lead to an increased adoption of wheel speed sensors. The wheel speed-sensor market stands to gain from this trend as manufacturers seek to develop vehicles that meet consumer demands for sustainability and cost-effectiveness.

Growth of Autonomous Vehicle Technology

The advancement of autonomous vehicle technology is poised to be a significant driver for the wheel speed-sensor market. As automakers invest heavily in developing self-driving capabilities, the need for precise data from wheel speed sensors becomes increasingly critical. These sensors provide real-time information that is essential for the vehicle's navigation and control systems. In the US, the autonomous vehicle market is anticipated to reach a valuation of $60 billion by 2030, which could lead to a substantial increase in demand for wheel speed sensors. The wheel speed-sensor market is likely to experience a surge in growth as manufacturers adapt to the evolving landscape of vehicle automation, necessitating the integration of advanced sensor technologies.

Rising Demand for Advanced Safety Features

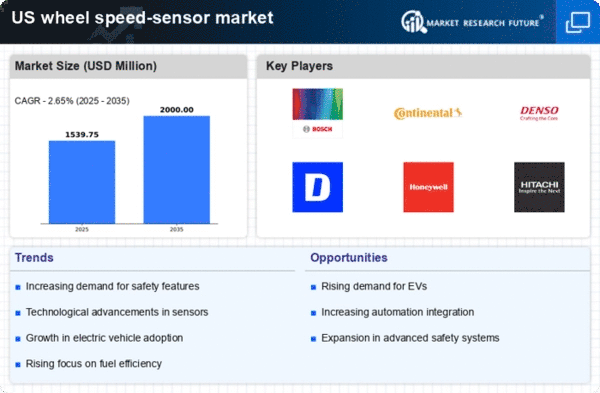

The increasing consumer demand for advanced safety features in vehicles is a primary driver for the wheel speed-sensor market. As automotive manufacturers strive to enhance vehicle safety, the integration of wheel speed sensors becomes essential for systems such as anti-lock braking systems (ABS) and electronic stability control (ESC). In the US, the market for these safety features is projected to grow at a CAGR of approximately 8% over the next five years. This growth is likely to be fueled by heightened awareness of road safety and the implementation of stricter safety regulations. Consequently, the wheel speed-sensor market is expected to benefit significantly from this trend, as manufacturers prioritize the incorporation of these sensors to meet consumer expectations and regulatory requirements.

Technological Innovations in Sensor Design

Technological innovations in sensor design are driving advancements in the wheel speed-sensor market. The development of more compact, efficient, and accurate sensors is enabling automotive manufacturers to enhance vehicle performance and safety. Innovations such as wireless sensors and improved signal processing technologies are becoming increasingly prevalent. In the US, the market for advanced sensor technologies is projected to grow by 12% over the next five years, indicating a robust demand for innovative solutions. The wheel speed-sensor market is likely to benefit from these technological advancements, as manufacturers seek to incorporate cutting-edge sensor designs that meet the evolving needs of modern vehicles.

Expansion of Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure in the US is likely to drive growth in the wheel speed-sensor market. As more consumers transition to electric vehicles, the demand for components that support EV technology, including wheel speed sensors, is expected to rise. These sensors are vital for managing the unique dynamics of electric drivetrains and ensuring optimal performance. The US government has committed to investing $7.5 billion in EV charging infrastructure, which could significantly boost the adoption of electric vehicles. Consequently, the wheel speed-sensor market may experience increased demand as manufacturers adapt to the growing EV market and the specific requirements associated with electric vehicle technology.