Rising Demand for Digital Content

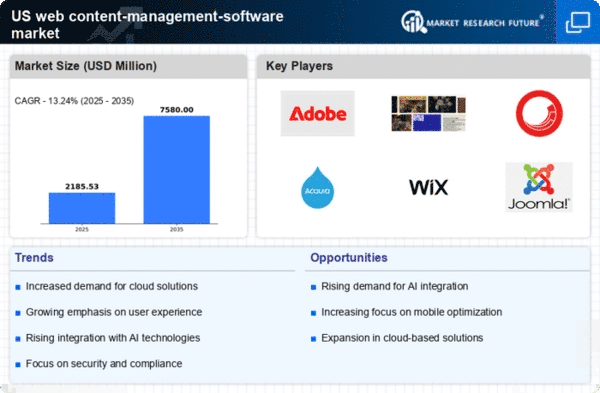

The web content-management-software market is experiencing a notable surge in demand for digital content creation and management. As businesses increasingly recognize the importance of maintaining an online presence, the need for efficient content management solutions has become paramount. In the US, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the necessity for organizations to produce high-quality content that engages users and enhances brand visibility. Consequently, companies are investing in advanced web content-management software to streamline their content workflows, ensuring timely updates and consistent messaging across various platforms. This trend indicates a shift towards more sophisticated content strategies, where the ability to manage and distribute content effectively is seen as a competitive advantage.

Need for Enhanced Security Features

The web content-management-software market is witnessing a heightened focus on security features. Organizations are increasingly concerned about data breaches and cyber threats. With the rise of digital content, the protection of sensitive information has become a top priority for businesses. In the US, it is reported that nearly 60% of companies have experienced a security incident related to their web content management systems. This alarming statistic underscores the necessity for robust security measures within web content-management software. As a result, vendors are integrating advanced security protocols, such as encryption and user authentication, to safeguard content and user data. This trend indicates that organizations are willing to invest in software solutions that not only enhance content management capabilities but also provide peace of mind regarding data security.

Emphasis on SEO and Digital Marketing

In the web content-management-software market, there is a growing emphasis on search engine optimization (SEO) and digital marketing strategies. Businesses are increasingly aware that effective content management is crucial for improving their online visibility and driving traffic to their websites. As a result, many organizations are adopting web content-management solutions that offer integrated SEO tools and analytics features. In the US, it is estimated that around 70% of marketers prioritize SEO in their content strategies, highlighting the importance of optimizing content for search engines. This trend suggests that web content-management software must evolve to include functionalities that support SEO best practices, enabling businesses to enhance their online presence and reach their target audiences more effectively.

Growing Importance of Mobile Optimization

The web content-management-software market is increasingly influenced by the growing importance of mobile optimization. As mobile device usage continues to rise, businesses are recognizing the need for their content to be accessible and user-friendly across various platforms. In the US, mobile traffic accounts for over 50% of total web traffic, making it essential for organizations to adopt web content-management solutions that facilitate mobile-friendly content creation and management. This trend suggests that software providers must prioritize mobile optimization features, enabling businesses to deliver seamless experiences to their users, regardless of the device used. Consequently, the demand for web content-management software that supports responsive design and mobile accessibility is likely to increase, shaping the future of content management strategies.

Integration of Analytics and Performance Metrics

The web content-management-software market is increasingly characterized by the integration of analytics and performance metrics into content management systems. Organizations are recognizing the value of data-driven decision-making in optimizing their content strategies. In the US, approximately 65% of marketers utilize analytics tools to measure the effectiveness of their content, indicating a strong demand for software that provides comprehensive insights into content performance. This trend suggests that web content-management solutions must evolve to incorporate advanced analytics capabilities, allowing businesses to track user engagement, conversion rates, and other key performance indicators. By leveraging these insights, organizations can refine their content strategies, ensuring that they meet the needs of their target audiences and achieve their marketing objectives.