Regulatory Support for Vitamin D Testing

Regulatory bodies in the US are increasingly recognizing the importance of vitamin D testing, which is positively impacting the vitamin d-testing market. Guidelines from health organizations are advocating for routine vitamin D assessments, particularly for vulnerable populations. This regulatory support is encouraging healthcare providers to incorporate vitamin D testing into standard practice, thereby driving market growth. The vitamin d-testing market is expected to expand as more healthcare policies promote preventive testing and coverage for vitamin D assessments. This alignment between regulatory frameworks and market needs could result in a substantial increase in testing services, with estimates suggesting a potential market growth of 10% over the next few years.

Growing Interest in Personalized Nutrition

The rising trend of personalized nutrition is becoming a significant driver for the vitamin d-testing market. Consumers are increasingly seeking tailored health solutions that cater to their individual needs, including vitamin D supplementation based on specific testing results. This shift is prompting healthcare professionals to recommend vitamin D testing as part of personalized health plans. The vitamin d-testing market is likely to benefit from this trend, as more individuals recognize the importance of understanding their unique nutritional requirements. As personalized health solutions gain traction, the market may see a notable increase in testing demand, potentially leading to a market growth rate of around 8% annually.

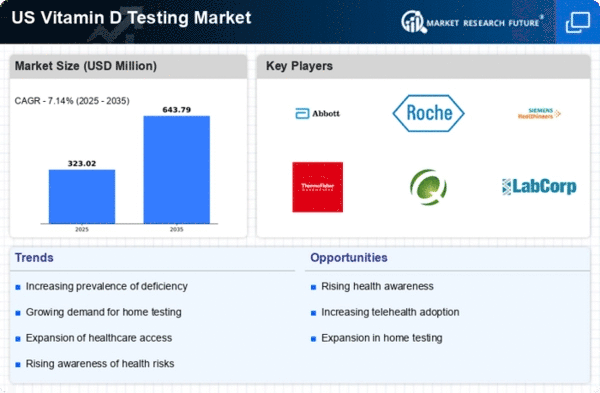

Increased Prevalence of Vitamin D Deficiency

The rising incidence of vitamin D deficiency in the US population is a critical driver for the vitamin d-testing market. Studies indicate that approximately 42% of adults in the US are vitamin D deficient, which has heightened awareness regarding the importance of monitoring vitamin D levels. This growing concern has led healthcare providers to recommend routine testing, thereby propelling the demand for testing services. Furthermore, the vitamin d-testing market is likely to benefit from increased educational campaigns aimed at informing the public about the health risks associated with low vitamin D levels, such as osteoporosis and cardiovascular diseases. As more individuals seek to understand their vitamin D status, the market is expected to expand significantly, with a projected growth rate of around 7% annually over the next few years.

Technological Advancements in Testing Methods

Innovations in testing technologies are transforming the vitamin d-testing market. The introduction of more accurate and user-friendly testing methods, such as high-throughput assays and point-of-care testing devices, is enhancing the accessibility and efficiency of vitamin D assessments. These advancements allow for quicker results and improved patient compliance, which is crucial in managing vitamin D levels effectively. The vitamin d-testing market is likely to see increased adoption of these technologies, as they cater to both clinical settings and home testing environments. As a result, the market could experience a surge in demand, with projections indicating a potential increase in market value by 15% over the next five years.

Expansion of Preventive Healthcare Initiatives

The shift towards preventive healthcare in the US is significantly influencing the vitamin d-testing market. With an increasing focus on early detection and prevention of health issues, healthcare systems are integrating vitamin D testing into routine health assessments. This trend is supported by various health organizations advocating for regular screening, particularly for at-risk populations such as the elderly and those with chronic illnesses. The vitamin d-testing market is poised to grow as healthcare providers adopt comprehensive screening protocols that include vitamin D assessments. This proactive approach not only enhances patient outcomes but also reduces long-term healthcare costs, making it a compelling driver for market expansion.