Rising Industrial Applications

The expansion of industrial applications for natural gas and other energy resources is a key driver for the virtual pipelines market. Industries such as manufacturing, power generation, and transportation are increasingly relying on virtual pipelines to meet their energy needs. The virtual pipelines market is likely to benefit from this trend, as industries seek to enhance their energy supply chains. With the US manufacturing sector projected to grow by 3% annually, the demand for efficient energy transport solutions will likely increase. This growth presents opportunities for virtual pipelines to establish themselves as a critical component in the energy supply chain.

Growing Demand for Energy Security

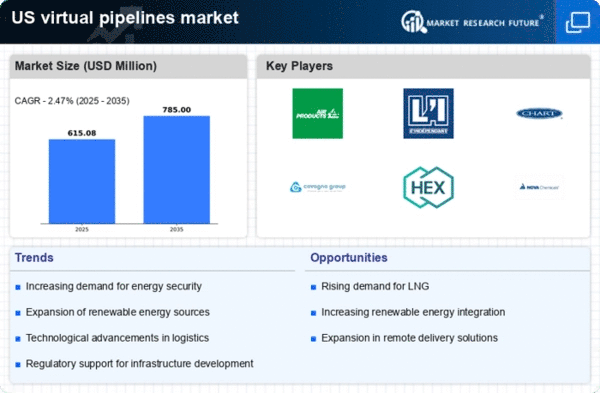

The increasing emphasis on energy security in the US is driving the virtual pipelines market. As energy consumers seek reliable and uninterrupted supply, virtual pipelines offer a flexible solution for transporting natural gas and other energy resources. This market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, reflecting the rising need for alternative energy transport methods. The virtual pipelines market is becoming essential for regions lacking traditional pipeline infrastructure, enabling energy access in remote areas. Furthermore, the ability to quickly adapt to changing energy demands enhances the attractiveness of virtual pipelines, positioning them as a viable option for energy companies aiming to ensure consistent supply amidst fluctuating market conditions.

Investment in Infrastructure Development

Investment in infrastructure development is a crucial factor influencing the virtual pipelines market. As the US government and private sector stakeholders allocate funds towards enhancing energy infrastructure, virtual pipelines are emerging as a cost-effective solution. The virtual pipelines market is expected to gain traction as investments in alternative energy transport methods rise. With an estimated $1 trillion earmarked for infrastructure improvements over the next decade, virtual pipelines could play a pivotal role in addressing energy distribution challenges. This influx of capital may lead to increased adoption of virtual pipelines, particularly in underserved regions.

Technological Innovations in Transportation

Technological advancements in transportation logistics are significantly impacting the virtual pipelines market. Innovations such as advanced compression technologies and real-time monitoring systems enhance the efficiency and safety of virtual pipeline operations. The integration of IoT and AI in managing virtual pipelines allows for better predictive maintenance and operational optimization. As a result, the virtual pipelines market is expected to witness increased investment in technology, with estimates suggesting a potential market size of $2 billion by 2030. These innovations not only improve operational efficiency but also reduce costs, making virtual pipelines a more attractive option for energy companies.

Environmental Considerations and Sustainability

The growing awareness of environmental issues is influencing the virtual pipelines market. As companies strive to reduce their carbon footprint, virtual pipelines present a cleaner alternative to traditional transportation methods. By minimizing methane emissions and reducing the need for extensive land use, the virtual pipelines market aligns with sustainability goals. The US government has set ambitious targets to cut greenhouse gas emissions by 50-52% by 2030, which may further propel the adoption of virtual pipelines. This shift towards greener energy solutions is likely to attract investments, as stakeholders recognize the potential for virtual pipelines to contribute to a more sustainable energy landscape.