Rising Pet Ownership

The veterinary animal-vaccines market experiences a notable boost due to the increasing trend of pet ownership across the United States. As more households adopt pets, the demand for veterinary services, including vaccinations, escalates. Recent statistics indicate that approximately 67% of U.S. households own a pet, which translates to around 85 million families. This surge in pet ownership correlates with a heightened awareness of animal health, prompting owners to seek preventive care through vaccinations. Consequently, the veterinary animal-vaccines market is likely to expand as pet owners prioritize the health and well-being of their animals, leading to increased spending on veterinary services and products.

Increased Veterinary Expenditures

The veterinary animal-vaccines market is positively impacted by the rising expenditures on veterinary care among pet owners. Recent surveys indicate that U.S. pet owners are willing to spend more on their animals' health, with average annual veterinary expenses reaching approximately $500 per pet. This trend reflects a growing recognition of the importance of preventive care, including vaccinations, in maintaining pet health. As pet owners allocate more resources to veterinary services, the demand for vaccines is likely to rise correspondingly. This increase in veterinary expenditures not only supports the veterinary animal-vaccines market but also encourages veterinary practices to offer a wider range of vaccination options, catering to the diverse needs of pet owners.

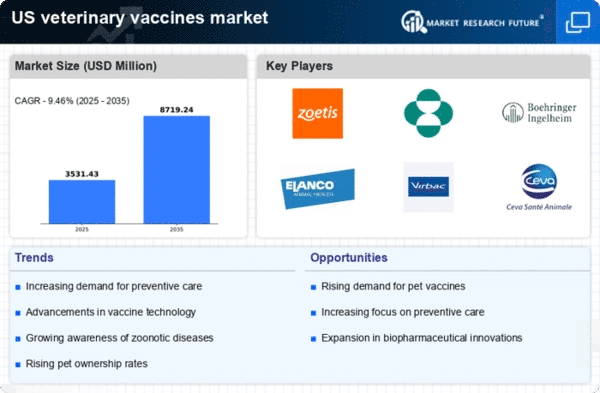

Advancements in Vaccine Technology

Innovations in vaccine technology are reshaping the veterinary animal-vaccines market, leading to the development of more effective and safer vaccines. Recent advancements include the use of recombinant DNA technology and mRNA vaccines, which have shown promise in enhancing immune responses in animals. These technological improvements not only increase the efficacy of vaccines but also reduce the incidence of adverse reactions. As veterinary professionals become more aware of these advancements, they are likely to adopt new vaccines, thereby driving growth in the veterinary animal-vaccines market. The potential for improved animal health outcomes may encourage pet owners to invest more in vaccination, further propelling market expansion.

Legislative Support for Animal Health

Legislative measures aimed at improving animal health and welfare are playing a crucial role in the veterinary animal-vaccines market. Various states have enacted laws that mandate vaccinations for certain diseases, particularly in livestock and companion animals. This regulatory framework not only ensures higher vaccination rates but also fosters a culture of preventive care among pet owners. The American Veterinary Medical Association (AVMA) supports these initiatives, recognizing their importance in safeguarding public health and animal welfare. As compliance with vaccination laws becomes more prevalent, the veterinary animal-vaccines market is expected to benefit from increased demand for vaccines, as pet owners seek to adhere to legal requirements.

Growing Awareness of Zoonotic Diseases

The veterinary animal-vaccines market is significantly influenced by the rising awareness of zoonotic diseases, which are diseases that can be transmitted from animals to humans. As public health campaigns emphasize the importance of preventing such diseases, pet owners are becoming more proactive in vaccinating their animals. This trend is particularly relevant in urban areas where the risk of zoonotic transmission may be higher. The Centers for Disease Control and Prevention (CDC) has reported that certain zoonotic diseases, such as rabies and leptospirosis, pose serious health risks. As a result, the veterinary animal-vaccines market is likely to see increased demand for vaccines that protect against these diseases, thereby enhancing overall public health.