Rising Energy Efficiency Standards

The vacuum insulation-panels market is experiencing a surge in demand due to the increasing energy efficiency standards set by regulatory bodies in the US. These standards aim to reduce energy consumption in buildings and appliances, thereby promoting the use of advanced insulation materials. Vacuum insulation panels, known for their superior thermal performance, are becoming a preferred choice among manufacturers seeking to comply with these regulations. The market is projected to grow as more industries adopt these panels to meet the stringent energy codes, which could lead to a market value increase of approximately 15% by 2027. This trend indicates a strong alignment between regulatory requirements and the adoption of vacuum insulation technology.

Growing Demand in Construction Sector

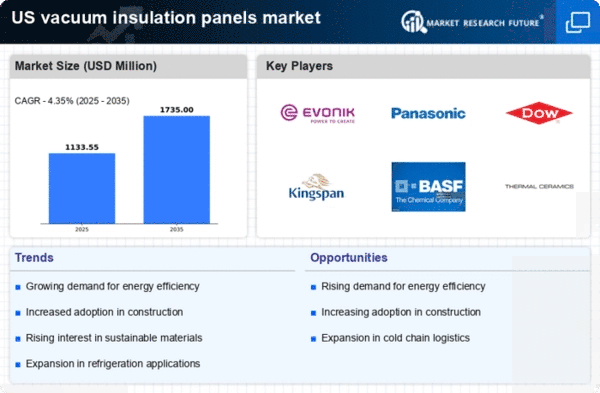

The construction sector in the US is witnessing a robust growth trajectory, which is positively impacting the vacuum insulation-panels market. As new building projects emerge, there is a heightened focus on energy-efficient materials that can enhance thermal performance. Vacuum insulation panels are increasingly being integrated into residential and commercial buildings, driven by the need for sustainable construction practices. The market is expected to expand significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 12% over the next five years. This growth is indicative of the construction industry's shift towards innovative insulation solutions that meet modern energy efficiency demands.

Technological Innovations in Manufacturing

Technological innovations in the manufacturing processes of vacuum insulation panels are playing a crucial role in the market's expansion. Advances in production techniques have led to improved panel performance, reduced costs, and enhanced durability. These innovations are making vacuum insulation panels more accessible to a broader range of applications, including refrigeration, building insulation, and packaging. The market is likely to benefit from these advancements, with projections indicating a potential increase in market share by 20% as manufacturers adopt cutting-edge technologies. This trend underscores the importance of continuous improvement in manufacturing to meet the evolving needs of the vacuum insulation-panels market.

Increased Awareness of Environmental Impact

There is a growing awareness among consumers and businesses regarding the environmental impact of insulation materials, which is driving the vacuum insulation-panels market. As sustainability becomes a priority, stakeholders are seeking materials that not only provide superior insulation but also have a lower carbon footprint. Vacuum insulation panels, often made from recyclable materials, align with these environmental goals. This shift in consumer preference is expected to propel market growth, with estimates suggesting a rise in demand by approximately 18% over the next few years. The emphasis on eco-friendly solutions is likely to reshape the landscape of the vacuum insulation-panels market.

Expansion of Refrigeration and Cold Chain Logistics

The expansion of the refrigeration and cold chain logistics sectors in the US is significantly influencing the vacuum insulation-panels market. As the demand for efficient temperature control in food and pharmaceutical industries increases, vacuum insulation panels are becoming essential for maintaining product integrity during transportation and storage. The market is projected to grow as companies invest in advanced insulation solutions to enhance energy efficiency and reduce operational costs. With an anticipated growth rate of around 10% in the cold chain logistics sector, the vacuum insulation-panels market is poised to benefit from this trend, highlighting the critical role of insulation in modern supply chains.