Rising Healthcare Expenditure

The urinary incontinence market is influenced by the rising healthcare expenditure in the United States. As individuals allocate more resources to healthcare, there is a corresponding increase in spending on products and services related to urinary incontinence. In 2025, healthcare spending is projected to reach $4 trillion, with a notable portion directed towards managing chronic conditions and improving quality of life. This trend suggests that as financial resources become more available, individuals are more likely to invest in solutions for urinary incontinence, thereby driving market growth. The urinary incontinence market stands to benefit from this increased expenditure.

Increased Focus on Women's Health

the urinary incontinence market benefits from a heightened focus on women's health issues. As awareness of female-specific health concerns grows, more women are seeking treatment for urinary incontinence, which is often underreported. Recent studies indicate that nearly 25% of women experience urinary incontinence at some point in their lives. This growing recognition is prompting healthcare providers to offer more targeted solutions, including pelvic floor therapy and specialized products. Consequently, the urinary incontinence market is likely to expand as more women become informed about their options and seek assistance for this condition.

Advancements in Product Development

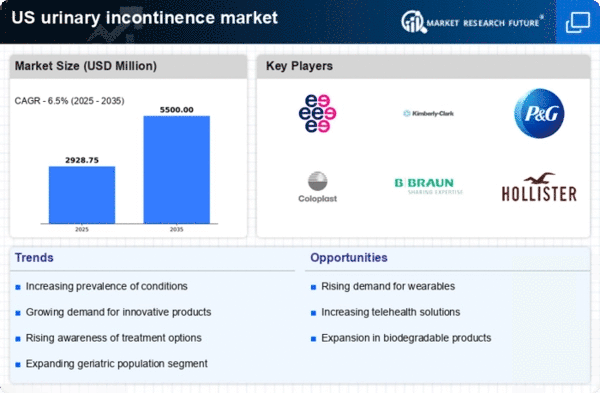

Innovations in product development are significantly impacting the urinary incontinence market. Manufacturers are increasingly investing in research and development to create more effective and comfortable products. For instance, the introduction of absorbent pads and wearable devices that monitor bladder activity has transformed the landscape. The market for these products is projected to reach $5 billion by 2026, indicating a robust growth trajectory. These advancements not only enhance user experience but also encourage more individuals to seek solutions for urinary incontinence, thereby expanding the market. As companies continue to innovate, the urinary incontinence market is expected to see a surge in demand.

Rising Prevalence of Chronic Conditions

the urinary incontinence market is growing due to the increasing prevalence of chronic conditions such as diabetes and obesity. These conditions are known to contribute to urinary incontinence, leading to a higher demand for related products and services. According to recent data, approximately 30% of adults with diabetes report experiencing some form of urinary incontinence. This trend suggests that as the population ages and chronic conditions become more common, the urinary incontinence market will likely expand. Furthermore, the healthcare system's focus on managing these chronic conditions may lead to increased awareness and treatment options, further driving the market's growth.

Growing Acceptance of Incontinence Products

The urinary incontinence market is experiencing a shift in societal attitudes towards incontinence products. There is a growing acceptance of these products, which is encouraging more individuals to seek help. This change is partly due to increased marketing efforts and the normalization of discussions surrounding urinary incontinence. Surveys indicate that nearly 60% of individuals are now more open to using incontinence products than in previous years. This cultural shift is likely to lead to higher sales and greater market penetration, as more people recognize the benefits of using these products. The urinary incontinence market is poised for growth as acceptance continues to rise.