Rising Geriatric Population

The rising geriatric population in the US is a significant factor contributing to the growth of the ultra high-definition-endoscopy market. As individuals age, they become more susceptible to various health issues, including gastrointestinal diseases and cancers, necessitating regular diagnostic procedures. The US Census Bureau projects that by 2030, approximately 20% of the population will be aged 65 and older, creating a substantial demand for effective diagnostic tools. Ultra high-definition endoscopy offers enhanced visualization, which is particularly beneficial for older patients who may have complex medical histories. This demographic shift suggests that healthcare providers will increasingly rely on ultra high-definition endoscopy technologies to address the unique healthcare needs of the aging population, thereby driving market growth.

Technological Innovations in Imaging

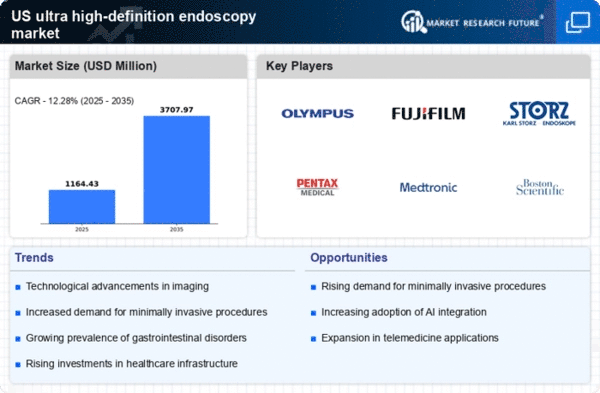

Technological innovations play a pivotal role in the ultra high-definition-endoscopy market. The introduction of advanced imaging technologies, such as high-resolution cameras and enhanced light sources, has significantly improved the quality of endoscopic procedures. These innovations allow for better visualization of internal structures, which is essential for accurate diagnosis and treatment. The market is projected to grow at a CAGR of 8.5% from 2025 to 2030, driven by these advancements. Furthermore, the integration of artificial intelligence in image analysis is expected to enhance diagnostic capabilities, making procedures more efficient. As healthcare facilities adopt these cutting-edge technologies, the ultra high-definition-endoscopy market is likely to expand, reflecting the ongoing commitment to improving patient outcomes.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in the US is a critical driver for the ultra high-definition-endoscopy market. As hospitals and outpatient facilities upgrade their equipment and expand their services, the demand for advanced endoscopic technologies is likely to increase. Investments in healthcare facilities are projected to reach $200 billion by 2026, with a significant portion allocated to diagnostic imaging technologies. This expansion not only enhances access to healthcare services but also encourages the adoption of ultra high-definition endoscopy systems. As more facilities integrate these advanced technologies, the market is expected to grow, reflecting the ongoing improvements in healthcare delivery and patient care.

Increasing Prevalence of Chronic Diseases

The ultra high-definition-endoscopy market is experiencing growth due to the rising prevalence of chronic diseases such as cancer, gastrointestinal disorders, and respiratory conditions in the US. As these diseases become more common, the demand for advanced diagnostic tools increases. The ability of ultra high-definition endoscopy to provide clearer images enhances the accuracy of diagnoses, which is crucial for effective treatment planning. According to recent data, the incidence of colorectal cancer alone is projected to rise by 2.2% annually, driving the need for improved endoscopic techniques. This trend suggests that healthcare providers are likely to invest more in ultra high-definition endoscopy technologies to meet the growing diagnostic needs, thereby propelling the market forward.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare among the US population, which is positively influencing the ultra high-definition-endoscopy market. Patients are becoming more proactive about their health, seeking regular screenings and diagnostic procedures to catch diseases early. This shift in mindset is leading to higher demand for advanced endoscopic techniques that offer superior imaging capabilities. As a result, healthcare providers are investing in ultra high-definition endoscopy equipment to meet this demand. The market is expected to witness a growth rate of approximately 7% annually as more individuals opt for preventive measures. This trend indicates a significant opportunity for manufacturers to develop and promote ultra high-definition endoscopy solutions tailored to the needs of health-conscious consumers.