Rising Environmental Regulations

The uav battery market is also influenced by the increasing stringency of environmental regulations. As governments implement policies aimed at reducing carbon emissions, there is a growing emphasis on sustainable practices within the UAV industry. This shift is prompting manufacturers to explore eco-friendly battery solutions, such as those utilizing recyclable materials or lower-impact production processes. The uav battery market may see a rise in demand for batteries that not only meet performance standards but also align with environmental regulations. Consequently, companies that prioritize sustainability in their battery designs could gain a competitive edge in this evolving market landscape.

Advancements in Battery Technology

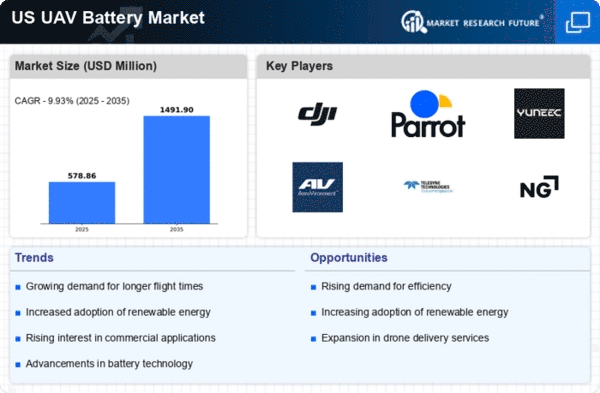

Technological innovations in battery technology are significantly influencing the uav battery market. The development of lithium-sulfur and solid-state batteries offers higher energy densities and improved safety profiles compared to traditional lithium-ion batteries. These advancements enable UAVs to achieve longer flight durations and enhanced performance, which are critical for commercial applications. The uav battery market is projected to benefit from these innovations, as manufacturers seek to integrate cutting-edge battery solutions into their UAV designs. Furthermore, the increasing focus on lightweight materials in battery construction may lead to a reduction in overall UAV weight, further enhancing operational efficiency and expanding the market's potential.

Increased Demand for Drone Applications

The The UAV battery market is experiencing a surge in demand driven by the expanding applications of drones across various sectors. Industries such as agriculture, logistics, and surveillance are increasingly adopting UAVs for their operational efficiency. For instance, the agricultural sector utilizes drones for precision farming, which enhances crop monitoring and reduces resource wastage. This growing adoption is projected to propel the uav battery market, with estimates suggesting a market growth rate of approximately 15% annually. As more businesses recognize the benefits of UAV technology, the demand for high-performance batteries that can support longer flight times and heavier payloads is likely to increase, thereby stimulating the uav battery market further.

Expansion of E-commerce and Delivery Services

The rapid expansion of e-commerce and delivery services is a significant driver for the uav battery market. As online shopping continues to grow, companies are increasingly looking to UAVs for last-mile delivery solutions. This trend necessitates the development of batteries that can support quick, efficient deliveries over varying distances. The uav battery market is likely to benefit from this demand, as businesses seek batteries that offer reliability and longevity. With projections indicating that the e-commerce sector could grow by over 20% in the coming years, the need for advanced UAV battery systems to facilitate this growth appears to be a critical factor influencing market dynamics.

Growing Investment in UAV Research and Development

Investment in research and development (R&D) for UAV technologies is a key driver of the uav battery market. Government and private sector funding is increasingly directed towards enhancing UAV capabilities, including battery performance. In the US, federal agencies have allocated substantial budgets for UAV-related projects, which include improving battery life and efficiency. This influx of capital is likely to foster innovation within the uav battery market, leading to the introduction of more advanced battery systems. As R&D efforts continue to evolve, the market may witness the emergence of new battery chemistries and technologies that could redefine operational standards for UAVs.