Increased Focus on Road Safety

An increased focus on road safety is a significant driver of the traffic sensor market. In the US, traffic accidents remain a major concern, prompting authorities to seek innovative solutions to enhance road safety. Traffic sensors play a vital role in monitoring traffic conditions and identifying hazardous situations in real-time. The implementation of advanced traffic sensors is likely to contribute to a reduction in accidents and fatalities. Recent studies indicate that cities employing intelligent traffic systems, which include traffic sensors, have experienced a decrease in accident rates by up to 20%. This emphasis on safety is expected to propel the traffic sensor market, as investments in safety technologies continue to rise.

Government Initiatives and Funding

Government initiatives and funding are pivotal drivers of the traffic sensor market. In the US, federal and state governments are allocating substantial budgets to improve transportation infrastructure. The Infrastructure Investment and Jobs Act, for instance, earmarks billions for modernizing traffic systems, which includes the deployment of advanced traffic sensors. This financial support is likely to stimulate market growth, as municipalities seek to enhance their traffic monitoring capabilities. The traffic sensor market is expected to benefit from these investments, with projections indicating a potential increase in market size by over $1 billion by 2030. Such initiatives underscore the importance of traffic sensors in achieving safer and more efficient transportation networks.

Rising Urbanization and Vehicle Ownership

Rising urbanization and vehicle ownership in the US are significantly impacting the traffic sensor market. As urban populations grow, the demand for efficient traffic management becomes increasingly critical. The US has witnessed a steady increase in vehicle ownership, with estimates suggesting that the number of registered vehicles could reach 300 million by 2026. This surge in vehicles leads to heightened traffic congestion, necessitating the deployment of advanced traffic sensors to monitor and manage traffic flow effectively. The traffic sensor market is likely to expand as cities invest in technologies that can accommodate the growing number of vehicles and improve overall traffic conditions.

Advancements in Traffic Management Systems

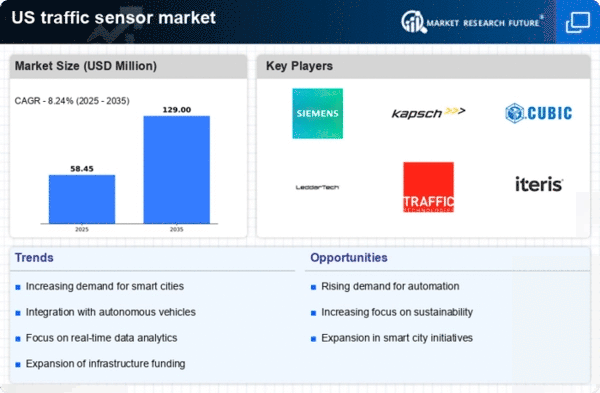

The traffic sensor market is experiencing a surge due to advancements in traffic management systems. These systems utilize real-time data from traffic sensors to optimize traffic flow, reduce congestion, and enhance road safety. In the US, cities are increasingly adopting intelligent transportation systems (ITS) that integrate traffic sensors with other technologies. This integration is projected to drive the market, as municipalities invest in smart infrastructure. According to recent estimates, the traffic management systems segment is expected to grow at a CAGR of approximately 10% over the next five years. This growth indicates a robust demand for traffic sensors, as they play a crucial role in providing the necessary data for effective traffic management.

Integration of Data Analytics in Traffic Monitoring

The integration of data analytics in traffic monitoring is transforming the traffic sensor market. By leveraging big data and analytics, traffic sensors can provide actionable insights that enhance traffic management strategies. In the US, municipalities are increasingly utilizing data analytics to predict traffic patterns, optimize signal timings, and improve road safety. This trend is expected to drive the demand for sophisticated traffic sensors capable of collecting and processing large volumes of data. The market for traffic sensors is projected to grow as cities recognize the value of data-driven decision-making in addressing traffic challenges. This integration may lead to a market growth rate of around 8% annually over the next few years.