Evolving Taste Preferences

The sugar free-beverage market is adapting to evolving taste preferences among consumers, who are increasingly seeking diverse and exciting flavor profiles. As traditional sugary beverages fall out of favor, there is a growing demand for sugar free options that do not compromise on taste. This shift is prompting manufacturers to experiment with unique flavor combinations and natural sweeteners, aiming to create products that appeal to a broader audience. Recent surveys indicate that nearly 60% of consumers are willing to try new flavors in sugar free beverages, suggesting a strong market potential for innovative offerings. This evolving landscape presents both challenges and opportunities for producers, as they strive to meet consumer expectations while maintaining product quality. The emphasis on flavor innovation is likely to play a pivotal role in the growth trajectory of the sugar free-beverage market.

Increasing Health Awareness

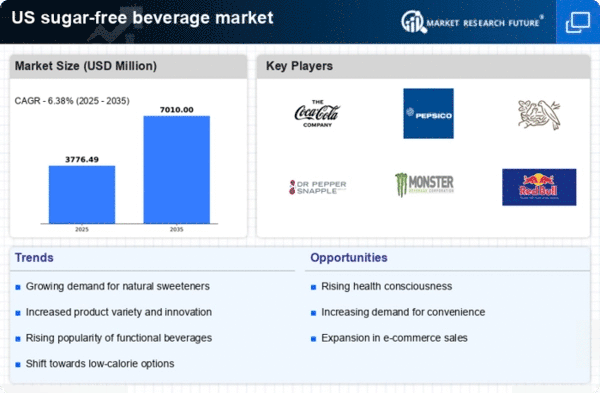

The sugar free-beverage market is experiencing a notable surge due to increasing health awareness among consumers. As individuals become more informed about the adverse effects of sugar consumption, particularly its link to obesity and diabetes, there is a growing demand for healthier alternatives. According to recent data, nearly 70% of consumers actively seek out sugar free options, indicating a significant shift in purchasing behavior. This trend is further supported by the rise in health-related campaigns and educational initiatives that emphasize the importance of reducing sugar intake. Consequently, manufacturers are responding by expanding their product lines to include a variety of sugar free beverages, catering to the evolving preferences of health-conscious consumers. This heightened awareness is likely to continue driving growth in the sugar free-beverage market, as more individuals prioritize their health and wellness in their dietary choices.

Rise of Functional Beverages

The sugar free-beverage market is witnessing a significant rise in the popularity of functional beverages, which offer added health benefits beyond basic hydration. These products often include ingredients such as vitamins, minerals, and probiotics, appealing to consumers seeking enhanced wellness solutions. Recent market data indicates that functional beverages account for approximately 25% of the overall beverage market, with sugar free options gaining traction among health-conscious individuals. This trend is indicative of a broader shift towards beverages that not only quench thirst but also contribute to overall health. As consumers increasingly prioritize functional benefits, manufacturers are likely to invest in research and development to create innovative sugar free beverages that cater to this demand. The growth of functional beverages is expected to significantly impact the sugar free-beverage market, driving both product innovation and consumer interest.

Regulatory Support for Healthier Products

The sugar free-beverage market is benefiting from increasing regulatory support aimed at promoting healthier food and beverage options. Government initiatives, such as taxes on sugary drinks and labeling requirements, are encouraging consumers to opt for sugar free alternatives. For instance, several states have implemented policies that incentivize the production and sale of low-sugar products, thereby fostering a more favorable environment for sugar free beverages. This regulatory landscape not only influences consumer behavior but also compels manufacturers to innovate and reformulate their products to meet new standards. As a result, the sugar free-beverage market is likely to see a rise in product availability and variety, as companies strive to comply with regulations while appealing to health-conscious consumers. This supportive regulatory framework is expected to play a crucial role in shaping the future of the sugar free-beverage market.

Sustainability Trends in Beverage Production

The sugar free-beverage market is increasingly influenced by sustainability trends, as consumers become more environmentally conscious. There is a growing expectation for brands to adopt sustainable practices in their production processes, including the sourcing of ingredients and packaging materials. Many consumers are now prioritizing products that are not only sugar free but also produced with minimal environmental impact. Recent studies show that approximately 40% of consumers are willing to pay a premium for beverages that are sustainably sourced and packaged. This trend is prompting manufacturers to explore eco-friendly alternatives and transparent supply chains, thereby enhancing their appeal to environmentally aware consumers. As sustainability becomes a key consideration in purchasing decisions, the sugar free-beverage market is likely to see a shift towards more responsible production practices, which could further drive growth and consumer loyalty.