Rising Demand for Clean Label Products

there is a notable shift towards clean label products in the specialty food-ingredients market., driven by consumer preferences for transparency and simplicity in food ingredients. As consumers increasingly scrutinize food labels, the demand for ingredients that are natural, minimally processed, and free from artificial additives is on the rise. According to industry reports, approximately 60% of consumers in the US are willing to pay a premium for clean label products. This trend is compelling manufacturers to reformulate their offerings, thereby creating opportunities for specialty food-ingredients that meet these criteria. The emphasis on clean labels is not merely a passing trend; it appears to be a fundamental change in consumer behavior, influencing purchasing decisions and shaping the future of the specialty food-ingredients market.

Innovation in Flavor and Texture Enhancement

Innovation plays a crucial role in the specialty food-ingredients market, particularly in the development of new flavors and textures that cater to evolving consumer tastes. As culinary trends shift towards more diverse and exotic flavors, manufacturers are increasingly investing in research and development to create unique ingredient profiles. This innovation is not only about enhancing taste but also about improving texture, which is vital for consumer satisfaction. The market for flavor enhancers is projected to grow at a CAGR of 5.5% over the next five years, indicating a robust demand for specialty food-ingredients that can elevate the sensory experience of food products. This focus on innovation is likely to drive competition and encourage the introduction of novel ingredients that align with consumer preferences.

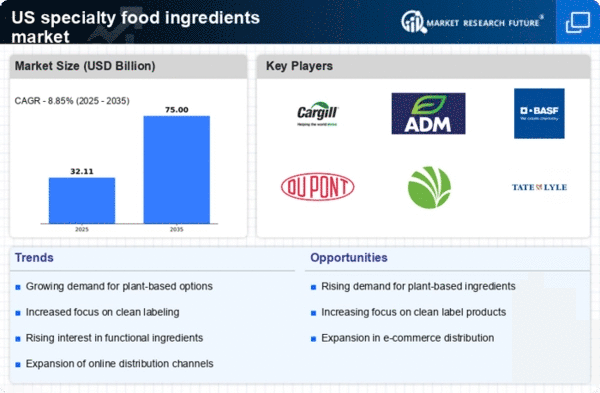

Increased Interest in Plant-Based Ingredients

there is a significant surge in the interest for plant-based ingredients., reflecting a broader shift towards vegetarian and vegan diets among consumers. This trend is fueled by health considerations, environmental concerns, and ethical considerations regarding animal welfare. Reports indicate that the plant-based food sector is expected to reach $74 billion by 2027, with specialty food-ingredients playing a pivotal role in this growth. Ingredients such as plant proteins, natural emulsifiers, and plant-derived flavors are becoming increasingly popular as they offer functional benefits while aligning with consumer values. This growing interest in plant-based options is likely to reshape product formulations and drive innovation within the specialty food-ingredients market.

Consumer Preference for Functional Ingredients

The specialty food-ingredients market is increasingly shaped by consumer preferences for functional ingredients that offer health benefits beyond basic nutrition. Ingredients such as probiotics, prebiotics, and fortified vitamins are gaining traction as consumers seek products that support overall wellness. This trend is reflected in market data, which suggests that the functional food sector is projected to grow at a CAGR of 8% over the next five years. As consumers become more health-conscious, the demand for specialty food-ingredients that provide specific health benefits is likely to rise. This shift not only influences product development but also encourages manufacturers to explore innovative formulations that cater to the growing desire for functional foods.

Regulatory Compliance and Food Safety Standards

Regulatory compliance and food safety standards are critical drivers in the specialty food-ingredients market, as manufacturers must adhere to stringent guidelines to ensure product safety and quality. The US Food and Drug Administration (FDA) and other regulatory bodies impose rigorous standards that govern the use of food ingredients, which can influence market dynamics. Companies are increasingly investing in quality assurance and compliance measures to meet these regulations, which can lead to higher operational costs. However, adherence to these standards also enhances consumer trust and can serve as a competitive advantage. As the specialty food-ingredients market continues to evolve, the importance of regulatory compliance is likely to remain a key factor influencing market growth and innovation.

.png)