Increased Focus on Soil Health

The increased focus on soil health is emerging as a critical driver in the US Specialty Fertilizers Market. Farmers are becoming more aware of the importance of maintaining soil fertility and structure, which directly influences crop productivity. Specialty fertilizers that enhance soil microbial activity and improve nutrient availability are gaining traction. This trend is supported by research indicating that healthy soils lead to better crop resilience and yield stability. As a result, the market for specialty fertilizers that promote soil health is expected to expand. Furthermore, educational programs and resources provided by agricultural extension services are helping farmers understand the benefits of using specialty fertilizers to maintain soil health, thereby driving market growth.

Government Regulations and Support

Government regulations and support are pivotal in influencing the US Specialty Fertilizers Market. The Environmental Protection Agency (EPA) and the Department of Agriculture (USDA) have established guidelines that promote the use of specialty fertilizers, particularly those that are environmentally friendly. These regulations encourage farmers to adopt fertilizers that comply with safety and environmental standards, thereby fostering a market for innovative products. Additionally, various subsidy programs and grants are available to support farmers in transitioning to specialty fertilizers that enhance soil health and crop productivity. This regulatory framework not only ensures compliance but also stimulates market growth by incentivizing the use of advanced fertilizers.

Sustainable Agriculture Initiatives

The US Specialty Fertilizers Market is experiencing a notable shift towards sustainable agriculture practices. This trend is driven by increasing consumer demand for organic and environmentally friendly products. As farmers adopt sustainable methods, the use of specialty fertilizers that enhance soil health and reduce chemical runoff becomes essential. According to recent data, the organic fertilizer segment is projected to grow significantly, reflecting a broader commitment to sustainability. The US government has also introduced various initiatives to promote sustainable farming, which further supports the adoption of specialty fertilizers. This alignment with environmental goals not only benefits the ecosystem but also enhances the market potential for specialty fertilizers that meet these criteria.

Rising Demand for High-Performance Fertilizers

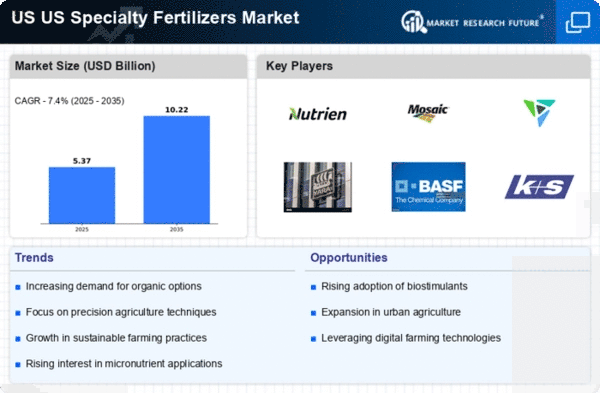

The demand for high-performance fertilizers is a significant driver in the US Specialty Fertilizers Market. As agricultural practices evolve, farmers are increasingly seeking fertilizers that provide enhanced nutrient profiles and improved crop yields. This trend is particularly evident in high-value crops such as fruits and vegetables, where the quality of produce directly impacts market prices. The specialty fertilizers segment, which includes micronutrients and bio-stimulants, is expected to witness robust growth as farmers recognize the benefits of these products. Market data indicates that the specialty fertilizers sector is anticipated to grow at a compound annual growth rate (CAGR) of over 5% in the coming years, reflecting the rising preference for high-performance solutions.

Technological Advancements in Fertilizer Production

Technological advancements are playing a crucial role in shaping the US Specialty Fertilizers Market. Innovations in fertilizer production processes, such as the development of slow-release and controlled-release fertilizers, are enhancing nutrient efficiency and minimizing environmental impact. These technologies allow for precise nutrient delivery, which is particularly beneficial in precision agriculture. The market for specialty fertilizers is projected to expand as farmers increasingly seek solutions that optimize crop yields while adhering to regulatory standards. Furthermore, the integration of data analytics and IoT in agriculture is enabling farmers to make informed decisions regarding fertilizer application, thereby driving demand for specialized products that align with these technological trends.