Government Initiatives and Support

Government initiatives play a vital role in shaping the solid state-lighting market, as various programs and policies promote the adoption of energy-efficient lighting solutions. Incentives such as tax credits, rebates, and grants are encouraging businesses and consumers to transition to solid state-lighting technologies. For instance, the Department of Energy has implemented programs aimed at increasing awareness and accessibility of energy-efficient lighting options. These initiatives not only support the growth of the solid state-lighting market but also align with national energy conservation goals. As regulatory frameworks continue to evolve, the market is likely to benefit from increased funding and support, fostering innovation and expansion within the industry.

Technological Advancements in Lighting

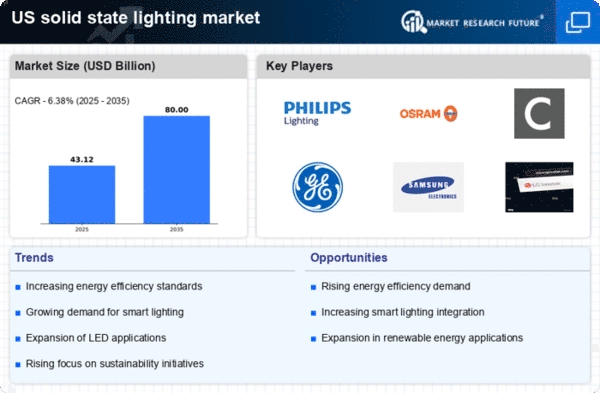

The solid state-lighting market is experiencing rapid technological advancements that enhance the performance and efficiency of lighting solutions. Innovations in LED technology, such as improved lumens per watt and longer lifespans, are driving adoption across various sectors. For instance, the efficacy of LEDs has increased significantly, with some products achieving over 200 lumens per watt. This trend not only reduces energy consumption but also lowers operational costs for businesses. As a result, the solid state-lighting market is projected to grow at a CAGR of approximately 15% through 2026, reflecting the increasing preference for advanced lighting solutions. Furthermore, the integration of smart lighting systems, which allow for remote control and automation, is likely to further propel market growth, making it a pivotal driver in the industry.

Sustainability and Environmental Concerns

Sustainability is becoming a crucial driver in the solid state-lighting market as consumers and businesses alike prioritize eco-friendly solutions. The shift towards sustainable practices is evident in the increasing demand for energy-efficient lighting options that reduce carbon footprints. Solid state-lighting technologies, particularly LEDs, consume up to 75% less energy than traditional incandescent bulbs, contributing to significant reductions in greenhouse gas emissions. Additionally, the solid state-lighting market is benefiting from the growing awareness of environmental issues, with many organizations committing to sustainability goals. This trend is expected to influence purchasing decisions, as consumers are more inclined to choose products that align with their values. Consequently, the market is likely to see a surge in demand for sustainable lighting solutions, further solidifying its position in the industry.

Cost-Effectiveness of Solid State Lighting

The cost-effectiveness of solid state-lighting solutions is a prominent driver in the market, as businesses seek to optimize their operational expenses. Although the initial investment for LED lighting may be higher than traditional options, the long-term savings on energy bills and maintenance costs are substantial. For example, the solid state-lighting market indicates that LED lights can last up to 25,000 hours, significantly reducing replacement frequency and associated costs. Moreover, the decreasing prices of LED technology, driven by advancements in manufacturing processes, are making these solutions more accessible to a broader range of consumers. As organizations recognize the financial benefits of switching to solid state-lighting, the market is expected to expand, with projections suggesting a growth rate of around 12% annually over the next few years.

Rising Demand in Commercial and Residential Sectors

The solid state-lighting market is witnessing a surge in demand from both commercial and residential sectors, driven by the need for efficient and versatile lighting solutions. In commercial spaces, businesses are increasingly adopting solid state-lighting to enhance energy efficiency and reduce operational costs. The retail sector, for example, is leveraging advanced lighting to create appealing environments that attract customers. Simultaneously, residential consumers are becoming more aware of the benefits of solid state-lighting, leading to increased adoption in homes. This dual demand is expected to propel the market forward, with estimates suggesting a growth trajectory of approximately 10% annually. As both sectors continue to embrace solid state-lighting technologies, the industry is poised for substantial expansion.