Growing Cybersecurity Concerns

With the rise of cyber threats, the importance of cybersecurity in software development has escalated. Organizations in the US are increasingly aware of the potential risks associated with software vulnerabilities, which can lead to data breaches and financial losses. This awareness is driving demand for comprehensive quality assurance practices that include security testing. Companies in the software quality-assurance market are adapting to this need by incorporating security measures into testing protocols. As a result, companies are investing in specialized tools and services to ensure their software is resilient against cyber threats, thereby contributing to the overall growth of the market.

Regulatory Compliance and Standards

In the US, regulatory compliance is becoming increasingly stringent across various industries, including finance, healthcare, and telecommunications. Organizations are compelled to adhere to specific standards that govern software quality, which directly impacts the software quality-assurance market. Compliance with regulations such as HIPAA and PCI DSS necessitates rigorous testing and validation processes. As a result, companies are investing in quality assurance solutions to ensure their software products meet these legal requirements. This trend not only enhances the credibility of software applications but also mitigates the risk of costly penalties, thereby driving growth in the software quality-assurance market.

Rising Demand for Software Reliability

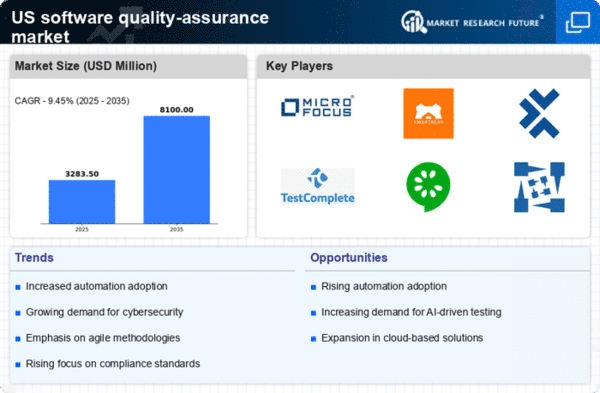

The increasing reliance on software applications across various sectors in the US has led to a heightened demand for reliability in software products. As businesses integrate more complex systems, the need for robust quality assurance processes becomes paramount. The demand for software quality assurance is growing as organizations seek to minimize downtime and enhance user satisfaction. In 2025, the market is projected to reach approximately $15 billion, reflecting a compound annual growth rate (CAGR) of around 10%. This trend indicates that companies are prioritizing quality assurance to ensure their software meets stringent performance standards, thereby driving investments in testing tools and methodologies.

Emergence of Cloud-Based Testing Solutions

The advent of cloud computing has transformed the software quality-assurance market by enabling organizations to leverage cloud-based testing solutions. These solutions offer scalability, flexibility, and cost-effectiveness, allowing businesses to conduct extensive testing without the need for significant infrastructure investments. In 2025, the market for cloud-based testing services is expected to grow by 15%, reflecting the increasing adoption of cloud technologies in software development. This trend indicates that companies are recognizing the advantages of cloud-based quality assurance tools, which facilitate collaboration and streamline testing processes, ultimately enhancing software quality.

Shift Towards Continuous Integration and Delivery

The software development landscape in the US is witnessing a significant shift towards continuous integration and continuous delivery (CI/CD) practices. This paradigm emphasizes the need for ongoing testing and quality assurance throughout the software development lifecycle. As organizations adopt CI/CD methodologies, the software quality-assurance market is likely to expand, with a projected growth rate of 12% annually. This shift encourages the integration of automated testing tools that facilitate rapid feedback and ensure that software releases maintain high quality. Consequently, businesses are increasingly recognizing the importance of quality assurance as a critical component of their development processes.