Consumer Health Consciousness

The increasing awareness of health issues related to high sodium intake is a primary driver for the sodium reduction-ingredients market. Consumers are becoming more informed about the risks associated with excessive sodium consumption, such as hypertension and cardiovascular diseases. This heightened consciousness is reflected in market trends, with a reported 30% of consumers actively seeking low-sodium options in their food products. As a result, food manufacturers are compelled to reformulate their products to meet this demand, thereby expanding the sodium reduction-ingredients market. The shift towards healthier eating habits is not merely a trend but appears to be a long-term change in consumer behavior, influencing purchasing decisions and driving innovation in ingredient development.

Innovation in Food Technology

Advancements in food technology are playing a crucial role in the sodium reduction-ingredients market. Innovative techniques, such as the use of potassium-based salt substitutes and flavor enhancers, are enabling manufacturers to reduce sodium levels without compromising taste. This technological evolution is essential, as taste remains a significant factor for consumers. The market is projected to grow by 20% annually, driven by these innovations that allow for healthier product formulations. Furthermore, the development of new processing methods and ingredient combinations is likely to enhance the appeal of low-sodium products, thereby expanding the sodium reduction-ingredients market and attracting a broader consumer base.

Rising Demand for Processed Foods

The growing demand for processed and convenience foods in the US is a notable driver for the sodium reduction-ingredients market. As busy lifestyles lead consumers to opt for ready-to-eat meals, the sodium content in these products often exceeds recommended levels. Consequently, food manufacturers are increasingly focusing on reformulating their offerings to include lower sodium options. This shift is expected to propel the sodium reduction-ingredients market, as companies seek to cater to health-conscious consumers. Market analysis indicates that the processed food sector could account for over 40% of the sodium reduction-ingredients market by 2026, highlighting the importance of this driver in shaping industry dynamics.

Regulatory Standards and Guidelines

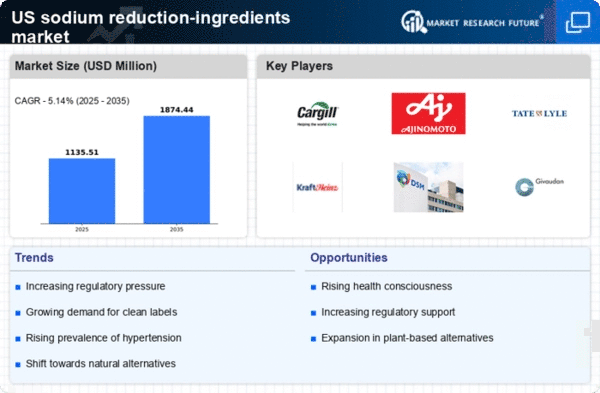

Regulatory bodies in the US are increasingly implementing stringent guidelines regarding sodium content in food products. The sodium reduction-ingredients market is significantly influenced by these regulations, which aim to improve public health outcomes. For instance, the FDA has set voluntary sodium reduction targets for various food categories, encouraging manufacturers to lower sodium levels. This regulatory push is expected to drive the sodium reduction-ingredients market, as companies seek compliant solutions to avoid penalties and meet consumer expectations. The market could see a growth rate of approximately 15% over the next five years, as businesses adapt to these evolving standards and invest in sodium reduction technologies.

Increased Competition Among Food Brands

The competitive landscape among food brands is intensifying, prompting a focus on healthier product offerings, including those with reduced sodium content. As consumers become more discerning, brands are differentiating themselves by promoting low-sodium options, thereby driving the sodium reduction-ingredients market. This competition is not only fostering innovation but also encouraging transparency in labeling, as consumers demand to know the sodium content of their food. Market projections suggest that brands emphasizing health and wellness could capture a larger market share, potentially increasing the sodium reduction-ingredients market's value by 25% over the next few years. This competitive pressure is likely to lead to a broader acceptance of sodium reduction ingredients across various food categories.