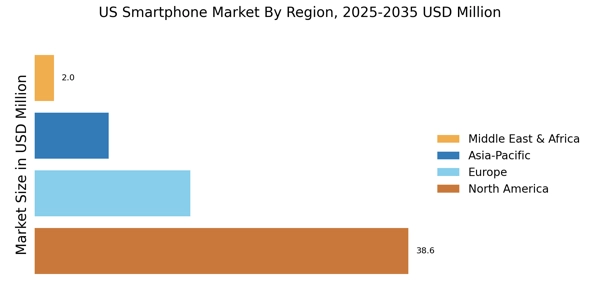

North America : Tech Innovation Leader

The North American smartphone market is primarily driven by technological innovation, consumer demand for high-performance devices, and a robust regulatory environment. The United States holds the largest market share at approximately 60%, followed by Canada at around 15%. Factors such as 5G adoption and increasing smartphone penetration among younger demographics are fueling growth. Regulatory support for technology development and consumer protection further enhances market dynamics. In this region, the competitive landscape is dominated by key players like Apple and Google, which lead in market share and innovation. Samsung and Motorola also maintain significant positions, catering to diverse consumer preferences. The presence of these major brands fosters a competitive environment, driving continuous advancements in smartphone technology and features, ensuring that North America remains at the forefront of The US Smartphone Market.

Europe : Emerging Market Dynamics

The European smartphone market is characterized by a growing demand for sustainable and innovative devices, with a market share of approximately 25%. Germany and the UK are the largest markets, accounting for about 30% and 25% of the region's sales, respectively. Regulatory initiatives aimed at reducing electronic waste and promoting energy efficiency are significant growth drivers. The EU's Green Deal and Digital Strategy are pivotal in shaping market trends and consumer preferences. Leading countries in Europe are Germany, the UK, and France, with a competitive landscape featuring brands like Samsung, Apple, and emerging players like OnePlus. The presence of diverse consumer preferences drives brands to innovate continuously, focusing on sustainability and advanced features. The competitive environment is further enhanced by local regulations that encourage responsible manufacturing and recycling practices, ensuring a dynamic market landscape.

Asia-Pacific : Rapid Growth Region

The Asia-Pacific smartphone market is experiencing rapid growth, driven by increasing urbanization, rising disposable incomes, and a young population. China and India are the largest markets, holding approximately 40% and 15% of the region's market share, respectively. The demand for affordable smartphones and advancements in mobile technology are key growth factors. Regulatory support for digital infrastructure development is also enhancing market dynamics, fostering a conducive environment for growth. In this region, major players include Xiaomi, Samsung, and Huawei, which cater to diverse consumer needs. The competitive landscape is marked by aggressive pricing strategies and continuous innovation. The presence of numerous local brands further intensifies competition, driving down prices and improving product offerings. As the market evolves, companies are increasingly focusing on 5G technology and AI integration to capture consumer interest and expand their market presence.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa smartphone market is on the rise, driven by increasing internet penetration, a young population, and growing demand for mobile connectivity. The region holds a market share of approximately 10%, with South Africa and Nigeria being the largest markets, accounting for about 25% and 20% of the region's sales, respectively. Regulatory initiatives aimed at improving digital infrastructure and connectivity are crucial for market growth, fostering an environment conducive to smartphone adoption. Leading countries in this region include South Africa, Nigeria, and Kenya, with a competitive landscape featuring brands like Samsung, Huawei, and local players. The presence of diverse consumer preferences drives brands to innovate continuously, focusing on affordability and functionality. As the market matures, companies are increasingly investing in marketing strategies to enhance brand visibility and capture the growing consumer base, ensuring a dynamic and competitive environment.