Emphasis on High-Quality Visuals

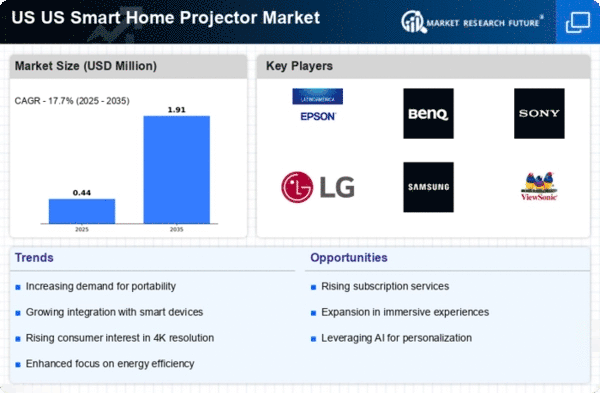

High-quality visuals remain a pivotal driver in the US Smart Home Projector Market. As consumers become more discerning about their viewing experiences, the demand for projectors that deliver superior image quality is on the rise. Recent market data indicates that projectors with 4K resolution capabilities have seen a significant uptick in sales, with a growth rate of around 30% year-over-year. This trend is indicative of a broader consumer expectation for cinematic experiences at home. Enhanced brightness, contrast ratios, and color accuracy are features that consumers are increasingly prioritizing. As technology advances, manufacturers are likely to invest in improving visual performance, thereby solidifying the position of high-quality projectors in the competitive landscape of smart home devices.

Integration with Smart Home Systems

The US Smart Home Projector Market is experiencing a notable surge due to the increasing integration of projectors with smart home systems. As consumers seek seamless connectivity, projectors that can easily interface with smart devices are becoming more desirable. This trend is supported by data indicating that over 60% of US households now utilize some form of smart technology. The ability to control projectors through voice commands or mobile applications enhances user experience, making these devices more appealing. Furthermore, the compatibility with platforms such as Amazon Alexa and Google Assistant is likely to drive sales, as consumers prioritize convenience and functionality in their home entertainment setups. This integration not only simplifies usage but also positions projectors as essential components of a modern smart home ecosystem.

Advancements in Projection Technology

Advancements in projection technology are significantly influencing the US Smart Home Projector Market. Innovations such as laser projection, LED technology, and ultra-short throw projectors are reshaping consumer expectations and experiences. These advancements not only improve image quality but also enhance the overall functionality of projectors. For instance, laser projectors offer longer lifespans and reduced maintenance costs, appealing to cost-conscious consumers. Data indicates that the adoption of laser projectors has increased by 20% in the last year, reflecting a growing preference for cutting-edge technology. As manufacturers continue to push the boundaries of what projectors can achieve, the market is likely to witness a surge in demand for these advanced devices, further solidifying their role in the smart home ecosystem.

Focus on Portability and Compact Design

Portability and compact design are emerging as critical drivers in the US Smart Home Projector Market. As urban living spaces become increasingly limited, consumers are gravitating towards projectors that offer flexibility without compromising on performance. The market has seen a rise in mini and portable projectors, which cater to the needs of individuals who desire mobility and ease of setup. Data suggests that sales of portable projectors have increased by approximately 25% in the past year, reflecting a shift in consumer preferences. These devices allow users to transform any space into a home theater, making them ideal for gatherings or outdoor movie nights. The emphasis on lightweight and compact designs is likely to continue, as manufacturers innovate to meet the demands of a dynamic consumer base.

Growing Demand for Home Entertainment Solutions

The growing demand for home entertainment solutions is a key driver in the US Smart Home Projector Market. With more individuals seeking alternatives to traditional television viewing, projectors are becoming a favored choice for immersive experiences. Market analysis reveals that the home entertainment segment is projected to grow by 15% annually, as consumers invest in creating personalized viewing environments. This shift is influenced by the increasing availability of streaming services and high-definition content, which enhances the appeal of projectors. Furthermore, the ability to project large images in various settings, from living rooms to backyards, positions projectors as versatile entertainment solutions. As consumer preferences evolve, the market is likely to see continued growth in this segment, driven by the desire for enhanced home entertainment options.