Top Industry Leaders in the US Satellite Data Service Market

Competitive Landscape of the US Satellite Data Service Market:

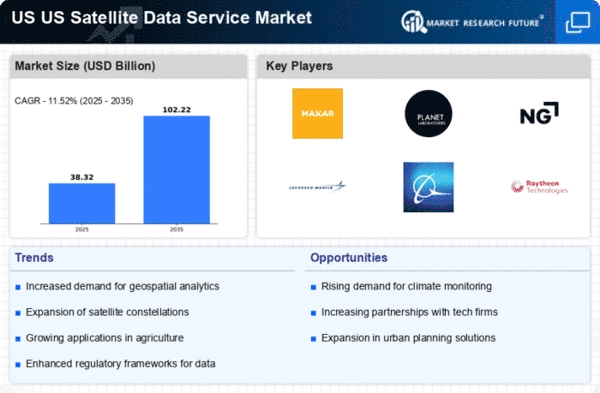

The US Satellite Data Service Market is burgeoning, propelled by rising demand for Earth observation data across diverse industries. This growth signifies intense competition amongst established players and a surge of innovative newcomers.

Key Players:

- Ursa Space Systems Inc.

- SpecTIR LLC

- Maxar Technologies

- Trimble Inc.

- Airbus S.A.S.

- Planet Labs Inc.

- Satellite Imaging Corporation

- ImageSat International (ISI)

- East View Geospatial Inc.

- L3Harris Technologies, Inc.

Strategies for Success:

- Constellation Expansion: Established players are aggressively expanding their constellations with next-generation satellites offering higher resolution, revisit rates, and spectral bands. Maxar's Legion satellites and Airbus' Pléiades Neo constellation exemplify this trend.

- Vertical Integration: Leading players are vertically integrating by acquiring analytics and software companies to offer end-to-end solutions that cater to specific industry needs. Maxar's purchase of Radiant Solutions and Blacksky's partnership with Descartes Labs are prime examples.

- Focus on Niche Applications: Specialty players are excelling by focusing on specific applications like agriculture, environmental monitoring, or defense & intelligence. They cater to unique customer needs with specialized data products and services.

- Partnerships and Acquisitions: Collaboration is key. New entrants are partnering with established players to leverage distribution networks and expertise, while incumbents acquire smaller companies to gain access to cutting-edge technologies.

- Data Democratization: Making satellite data readily available and affordable through cloud platforms and subscription models is a crucial strategy for both established and new players. Planet Labs' PlanetScope constellation and Blacksky's Mosaic platform exemplify this approach.

Factors for Market Share Analysis:

- Technology: Innovation in satellite design, sensors, data processing, and analytics significantly impacts competitiveness. Companies offering high-resolution, multispectral data with advanced analytics capabilities gain an edge.

- Distribution and Partnerships: Widespread data access, strong channel partnerships, and a global reach influence market share. Companies with established distribution networks and strategic partnerships have an advantage.

- Application Expertise: Deep understanding of specific industry needs and tailoring data products and services accordingly is crucial. Players addressing niche applications with specialized solutions gain market share.

- Pricing and Agility: Flexible pricing models that cater to diverse customer needs and budgets are essential. Additionally, the ability to adapt quickly to changing market dynamics and customer requirements is critical.

Investment Trends:

- Constellation Development: Significant investments are pouring into developing next-generation satellite constellations with advanced capabilities. Companies are raising capital through venture funding, public offerings, and government contracts.

- AI and Analytics: Integration of AI and machine learning into data processing and analysis platforms is a major investment focus. This enables extraction of deeper insights and creation of value-added products.

- Strategic Acquisitions: Mergers and acquisitions are on the rise as companies seek to expand their offerings, gain access to new technologies, and enter new markets.

- Vertical Market Expansion: Investment in developing specialized data products and services tailored to specific vertical industries like agriculture, infrastructure, and defense is increasing.

Latest Company Updates:

Feb 17, 2024: L3Harris unveiled a new AI-powered platform for analyzing satellite imagery for defense and intelligence applications.

Feb 8, 2024: ICEYE demonstrated its synthetic aperture radar satellite's ability to detect sub-meter changes in real-time, enhancing monitoring capabilities.

Jan 30, 2024: Trimble introduced a new high-precision GNSS receiver integrated with satellite imagery for improved agricultural applications.