Us Satcom Size

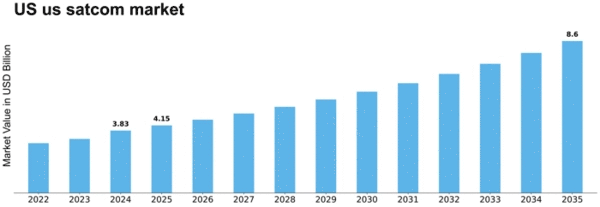

US SATCOM Market Growth Projections and Opportunities

The US SATCOM (Satellite Communication) market is heavily influenced by several key factors that drive its growth and development. One significant factor is the increasing demand for reliable and secure communication solutions across various industries, including telecommunications, government and defense, aviation, maritime, and broadcasting. SATCOM technology offers a robust and resilient means of communication, enabling seamless connectivity and data transmission over vast distances, regardless of geographical barriers or terrestrial infrastructure limitations. As organizations increasingly rely on high-speed, low-latency communication networks to support their operations and services, there is a growing demand for SATCOM solutions that can provide reliable connectivity and support a wide range of applications.

Moreover, technological advancements play a crucial role in shaping the US SATCOM market. The ongoing development of satellite technology, including the deployment of high-throughput satellites (HTS), small satellites (SmallSats), and low Earth orbit (LEO) constellations, enables SATCOM providers to offer enhanced performance, capacity, and coverage for their customers. These technological advancements drive market growth by expanding the capabilities and scalability of SATCOM networks, enabling providers to deliver higher bandwidth, lower latency, and more reliable communication services to their customers across various industries and applications.

Furthermore, increasing government investment in space exploration and national security initiatives drives market growth for US SATCOM solutions. The US government plays a significant role in shaping the SATCOM market through its investment in satellite infrastructure, research and development, and defense programs. Government agencies and military organizations rely on SATCOM technology for secure and resilient communication capabilities to support mission-critical operations, command and control systems, intelligence gathering, and situational awareness. As a result, there is a growing demand for SATCOM solutions that can meet the stringent requirements and security standards of government and defense customers, driving market growth and innovation in the US SATCOM sector.

Additionally, the growing demand for broadband connectivity in remote and underserved areas contributes to market growth for US SATCOM solutions. SATCOM technology offers a cost-effective and scalable solution for delivering high-speed internet access to rural communities, remote regions, and areas lacking terrestrial infrastructure. Satellite broadband services enable residents, businesses, and governments in these areas to access essential services such as telemedicine, distance learning, e-commerce, and government services, driving market demand for SATCOM solutions that can provide reliable and affordable connectivity to underserved populations.

Moreover, the increasing adoption of connected devices, IoT (Internet of Things) applications, and M2M (Machine-to-Machine) communications drives market growth for US SATCOM solutions. As the number of connected devices and IoT applications continues to proliferate across various industries, there is a growing need for robust and reliable communication networks to support data transmission, remote monitoring, and control capabilities. SATCOM technology offers a scalable and secure solution for connecting IoT devices, sensors, and M2M applications, enabling organizations to collect and analyze data in real-time, optimize operations, and improve efficiency, driving market demand for SATCOM solutions that can support the growing IoT ecosystem.

Furthermore, the increasing demand for mobility and connectivity in the aviation and maritime sectors drives market growth for US SATCOM solutions. Airlines, commercial shipping companies, and maritime operators rely on SATCOM technology to provide passengers and crew with high-speed internet access, voice communication, and entertainment services while traveling over land, sea, or air. SATCOM solutions enable seamless connectivity and communication, even in remote and oceanic regions, enhancing the passenger experience, improving operational efficiency, and ensuring safety and security for travelers and crew members. As a result, there is a growing demand for SATCOM solutions that can meet the unique requirements and challenges of the aviation and maritime industries, driving market growth and innovation in the US SATCOM market.

Leave a Comment