E-commerce Growth Surge

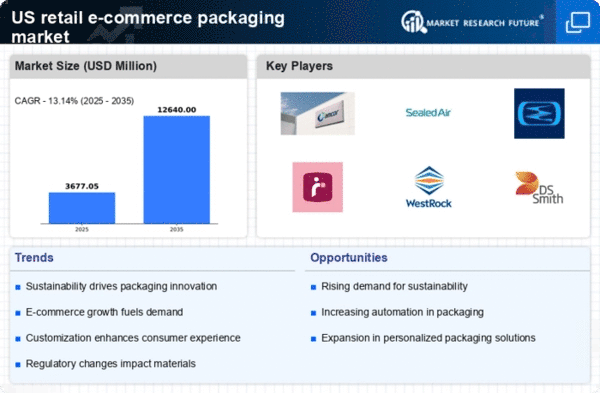

The retail e-commerce-packaging market is experiencing a notable surge due to the rapid growth of online shopping. In 2025, e-commerce sales in the US are projected to reach approximately $1 trillion, indicating a robust demand for packaging solutions tailored to online retail. This growth necessitates innovative packaging designs that not only protect products during transit but also enhance the unboxing experience for consumers. As more businesses transition to e-commerce platforms, the need for efficient and sustainable packaging solutions becomes increasingly critical. The retail e-commerce-packaging market is thus positioned to benefit from this upward trend, as companies seek to optimize their packaging strategies to meet consumer expectations and regulatory requirements.

Rise of Subscription Services

The rise of subscription services is significantly impacting the retail e-commerce-packaging market, as these models require specialized packaging solutions to enhance customer retention. Subscription boxes often prioritize unique and aesthetically pleasing packaging to create a memorable unboxing experience. This trend is evident in various sectors, including beauty, food, and lifestyle products, where companies invest in custom packaging to differentiate themselves in a competitive market. As subscription services continue to proliferate, the demand for innovative and engaging packaging solutions is likely to increase, further propelling growth in the retail e-commerce-packaging market.

Consumer Demand for Convenience

In the retail e-commerce-packaging market, consumer preferences are shifting towards convenience, driving the demand for packaging that facilitates easy handling and disposal. As consumers increasingly prioritize time-saving solutions, packaging that is easy to open, resealable, or designed for single-use is gaining traction. This trend is reflected in the growing popularity of packaging formats such as pouches and easy-tear bags. Furthermore, studies indicate that 70% of consumers are more likely to repurchase from brands that offer convenient packaging. Consequently, businesses are compelled to innovate their packaging solutions to align with consumer expectations, thereby propelling growth in the retail e-commerce-packaging market.

Regulatory Compliance and Standards

The retail e-commerce-packaging market is significantly influenced by evolving regulatory frameworks aimed at reducing environmental impact. In the US, regulations concerning packaging waste and recyclability are becoming more stringent, compelling companies to adopt sustainable practices. For instance, the introduction of extended producer responsibility (EPR) laws mandates that manufacturers take responsibility for the entire lifecycle of their packaging. This shift towards compliance not only drives innovation in sustainable materials but also influences consumer purchasing decisions, as 65% of consumers prefer brands that demonstrate environmental responsibility. As a result, the retail e-commerce-packaging market is likely to see increased investment in eco-friendly packaging solutions.

Technological Advancements in Packaging

Technological advancements are reshaping the retail e-commerce-packaging market, enabling companies to enhance efficiency and reduce costs. Innovations such as smart packaging, which incorporates QR codes and NFC technology, allow for improved tracking and consumer engagement. Additionally, automation in packaging processes is streamlining operations, reducing labor costs, and minimizing errors. The integration of data analytics is also facilitating better inventory management and demand forecasting, which is crucial for e-commerce businesses. As these technologies continue to evolve, they are expected to play a pivotal role in optimizing packaging solutions, thereby driving growth in the retail e-commerce-packaging market.