Economic Migration Trends

Economic migration continues to be a driving force in the remittance market. In the US, the influx of immigrants seeking better job opportunities contributes significantly to remittance flows. In 2025, remittances sent from the US are projected to reach approximately $70 billion, with a substantial portion directed towards families in home countries. This trend indicates a strong connection between economic conditions in the US and the financial support provided by migrants to their families abroad. As economic opportunities fluctuate, the remittance market may experience corresponding shifts in transaction volumes.

Increased Financial Inclusion Initiatives

Financial inclusion initiatives are playing a crucial role in shaping the remittance market. Various organizations and government programs are working to provide unbanked populations with access to financial services. In 2025, it is anticipated that around 25% of remittance recipients in the US will utilize alternative financial services, such as mobile wallets and prepaid cards. This shift not only broadens the customer base for remittance services but also enhances the overall efficiency of money transfers. As more individuals gain access to financial tools, the remittance market is likely to expand, fostering economic growth.

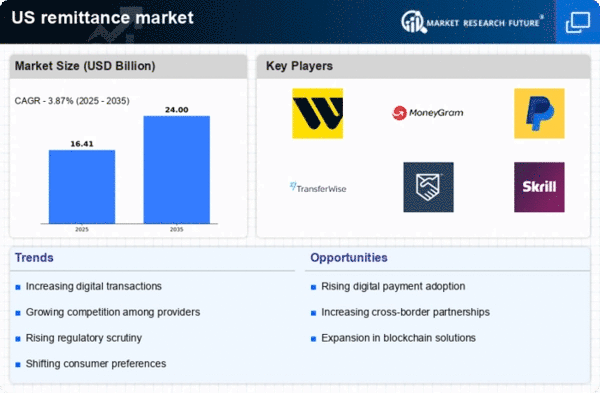

Competitive Landscape and Pricing Strategies

The competitive landscape within the remittance market is intensifying, leading to innovative pricing strategies among service providers. Companies are increasingly adopting transparent fee structures to attract customers, with some offering zero-fee transfers for specific corridors. In 2025, it is estimated that the average transaction fee for remittances will decrease to around 5%, down from 7% in previous years. This shift not only benefits consumers but also encourages greater participation in the remittance market. As competition escalates, service providers may need to continuously adapt their offerings to maintain market share.

Regulatory Compliance and Consumer Protection

Regulatory compliance remains a pivotal factor influencing the remittance market. In the US, stringent regulations are being implemented to enhance consumer protection and prevent fraud. By 2025, it is expected that compliance costs for remittance service providers will rise, potentially impacting pricing structures. However, these regulations also foster trust among consumers, encouraging them to engage more actively in the remittance market. As regulatory frameworks evolve, companies that prioritize compliance may gain a competitive edge, positioning themselves favorably in a market that values security and transparency.

Technological Advancements in Payment Systems

The remittance market is experiencing a notable shift due to rapid technological advancements in payment systems. Innovations such as blockchain technology and mobile payment applications are enhancing transaction speed and security. In 2025, it is estimated that over 60% of remittance transactions in the US will be conducted through digital platforms, reflecting a growing preference for convenience and efficiency. These advancements not only reduce transaction costs but also improve accessibility for users, particularly among younger demographics. As a result, the remittance market is likely to see increased participation from tech-savvy consumers who prioritize seamless digital experiences.