Growing Awareness of Genetic Disorders

The recombinant dna-technology market is also driven by the growing awareness of genetic disorders among the public and healthcare professionals. As more individuals become informed about genetic conditions, there is an increasing demand for diagnostic tools and treatments that utilize recombinant dna technologies. This awareness is leading to a rise in genetic testing services, which are projected to grow by 15% annually through 2025. Consequently, the recombinant dna-technology market is poised to benefit from this trend, as healthcare providers seek innovative solutions to address genetic disorders. The integration of these technologies into clinical practice is likely to enhance patient outcomes and drive market growth.

Expansion of Agricultural Biotechnology

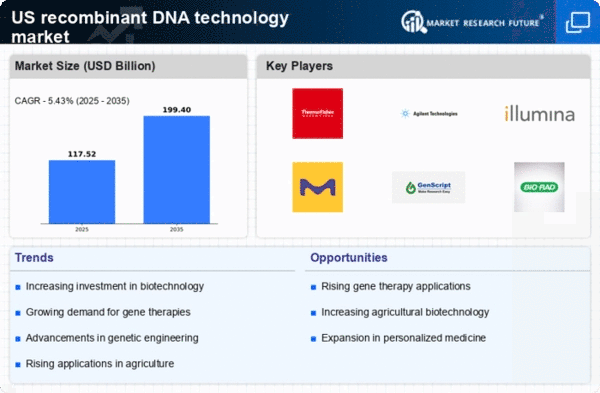

The recombinant dna-technology market is experiencing growth due to the expansion of agricultural biotechnology. As the global population continues to rise, there is an urgent need for sustainable agricultural practices that can increase crop yields and resilience. The use of recombinant dna technologies in developing genetically modified crops is becoming increasingly prevalent. In 2025, the market for agricultural biotechnology is expected to reach $8 billion, reflecting a growing acceptance of GMOs among consumers and farmers alike. This trend is likely to enhance the recombinant dna-technology market, as innovations in crop genetics lead to improved food security and environmental sustainability.

Rising Demand for Personalized Medicine

The recombinant dna-technology market is significantly influenced by the rising demand for personalized medicine. As healthcare shifts towards tailored treatments, the need for genetic testing and therapies that cater to individual genetic profiles is increasing. This trend is evident in the biopharmaceutical sector, where companies are investing heavily in developing targeted therapies based on genetic information. In 2025, the market for personalized medicine is expected to grow at a CAGR of over 10%, indicating a robust opportunity for recombinant dna technologies. The ability to create specific treatments for conditions such as cancer and rare genetic disorders is driving this demand, thereby enhancing the overall landscape of the recombinant dna-technology market.

Increased Funding for Biotechnology Research

The recombinant dna-technology market is benefiting from increased funding for biotechnology research. Government initiatives and private investments are fueling innovation in genetic research and development. In the US, funding for biotechnology research has seen a substantial rise, with federal grants and venture capital investments reaching over $5 billion in 2025. This influx of capital is enabling researchers to explore new applications of recombinant dna technologies, from drug development to agricultural enhancements. As research progresses, the recombinant dna-technology market is likely to expand, with new products and solutions emerging to meet the evolving needs of various industries.

Advancements in Genetic Engineering Techniques

The recombinant dna-technology market is experiencing a surge due to advancements in genetic engineering techniques. Innovations such as CRISPR and TALEN have revolutionized the ability to edit genes with precision. These technologies enable researchers to develop new therapies for genetic disorders, enhancing the market's growth potential. In 2025, the market is projected to reach approximately $10 billion, driven by the increasing application of these techniques in pharmaceuticals and agriculture. The ability to create genetically modified organisms (GMOs) that are resistant to diseases and pests is particularly appealing to agricultural sectors, thereby expanding the recombinant dna-technology market. As these techniques become more refined, their adoption across various industries is likely to accelerate, further propelling market growth.