Diverse Dietary Preferences

The ready meal-trays market is adapting to the evolving dietary preferences of consumers, becoming a significant driver of growth. With an increasing awareness of health and nutrition, many consumers are seeking meal options that align with specific dietary needs, such as gluten-free, vegan, or low-carb diets. Recent surveys indicate that nearly 40% of consumers are actively looking for meals that cater to their dietary restrictions. This shift is prompting manufacturers to innovate and diversify their product offerings, ensuring that they meet the demands of a broader audience. As a result, the ready meal-trays market is likely to see an expansion in its product lines, catering to various dietary trends and preferences, which could enhance market penetration and consumer loyalty.

Innovative Marketing Strategies

Innovative marketing strategies increasingly influence the ready meal-trays market, resonating with modern consumers. As competition intensifies, brands are leveraging social media, influencer partnerships, and targeted advertising to engage potential customers. Recent data indicates that brands utilizing social media marketing have seen a 25% increase in consumer engagement. This shift towards digital marketing is crucial, as it allows companies to showcase their meal offerings in a visually appealing manner, highlighting unique selling points such as convenience, taste, and nutritional value. Additionally, storytelling and brand narratives are becoming essential tools in connecting with consumers on a personal level. As these innovative marketing strategies continue to evolve, they are likely to play a pivotal role in shaping consumer perceptions and driving growth in the ready meal-trays market.

Convenience and Time-Saving Solutions

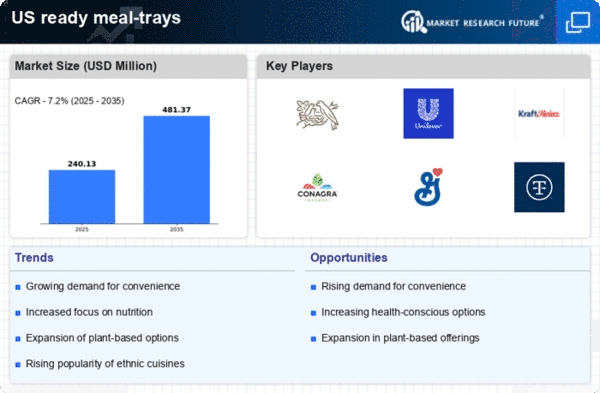

The ready meal-trays market is experiencing increased demand due to the need for convenience among consumers. Busy lifestyles and the growing number of dual-income households in the US have led to a preference for quick meal solutions. According to recent data, approximately 60% of consumers express a desire for meals that can be prepared in under 10 minutes. This trend indicates a shift towards ready meal-trays that offer not only convenience but also a variety of options to cater to diverse dietary preferences. As a result, manufacturers are focusing on creating meal-trays that are easy to heat and serve, thereby enhancing the appeal of the ready meal-trays market. The emphasis on convenience is likely to continue driving growth in this sector, as consumers prioritize time-saving solutions in their meal choices.

Increased Focus on Quality and Freshness

The ready meal-trays market is witnessing a heightened emphasis on quality and freshness. This trend is driven by consumer expectations for better food experiences. As consumers become more discerning about the ingredients and preparation methods used in their meals, manufacturers are responding by prioritizing high-quality, fresh ingredients in their offerings. Recent studies indicate that nearly 70% of consumers are willing to pay a premium for meals that are perceived as fresh and of superior quality. This trend is prompting brands to invest in sourcing local and organic ingredients, thereby enhancing the overall appeal of their meal-trays. The focus on quality and freshness is likely to differentiate products in the ready meal-trays market, fostering brand loyalty and encouraging repeat purchases among health-conscious consumers.

Rising E-commerce and Online Grocery Shopping

The ready meal-trays market is experiencing the rapid growth of e-commerce and online grocery shopping in the US. As consumers increasingly turn to online platforms for their grocery needs, the accessibility of ready meal-trays has improved significantly. Data suggests that online grocery sales have surged by over 30% in recent years, with a notable portion of these sales attributed to ready meal-trays. This trend indicates that consumers are more inclined to purchase meal solutions that can be conveniently delivered to their homes. Consequently, retailers and manufacturers are investing in online marketing strategies and partnerships with delivery services to enhance their reach. The expansion of e-commerce is likely to play a crucial role in shaping the future of the ready meal-trays market, as it aligns with consumer preferences for convenience and accessibility.