Increased Focus on Cybersecurity

As the public safety-lte market expands, the focus on cybersecurity is becoming increasingly critical. With the rise of digital communication systems, public safety agencies are more vulnerable to cyber threats. Consequently, there is a growing emphasis on implementing robust cybersecurity measures to protect sensitive data and communication channels. Investments in cybersecurity solutions are projected to increase by 20% annually, reflecting the urgent need for secure communication infrastructures. This heightened focus on cybersecurity not only safeguards public safety operations but also instills confidence among stakeholders, thereby fostering growth in the public safety-lte market.

Advancements in Network Technology

Technological advancements in network infrastructure are significantly influencing the public safety-lte market. The transition from 4G to 5G technology is expected to enhance the capabilities of LTE networks, providing faster data speeds and lower latency. This transition is crucial for applications such as real-time video streaming and high-definition data transfer, which are essential for public safety operations. Analysts predict that the adoption of 5G technology in public safety applications could increase operational efficiency by up to 30%. As agencies upgrade their systems to leverage these advancements, the public safety-lte market is likely to witness substantial growth, driven by the demand for cutting-edge communication solutions.

Integration of IoT in Public Safety

The integration of Internet of Things (IoT) technologies is emerging as a significant driver in the public safety-lte market. IoT devices, such as smart sensors and cameras, are increasingly being utilized to enhance situational awareness for first responders. These devices can transmit real-time data over LTE networks, improving decision-making during emergencies. The market for IoT in public safety is expected to reach $10 billion by 2026, indicating a strong trend towards adopting connected technologies. This integration not only enhances operational efficiency but also ensures that public safety agencies can respond more effectively to incidents, thereby driving growth in the public safety-lte market.

Regulatory Support for Enhanced Safety

Regulatory frameworks are playing a crucial role in shaping the public safety-lte market. Government initiatives aimed at enhancing public safety are leading to increased funding and support for LTE networks. For instance, the First Responder Network Authority (FirstNet) has been instrumental in establishing a dedicated LTE network for public safety. This initiative is expected to allocate over $6.5 billion for the development and maintenance of the network. Such regulatory support not only boosts the public safety-lte market but also encourages collaboration among various stakeholders, including telecommunications providers and public safety agencies, to create a more integrated communication environment.

Growing Demand for Reliable Communication

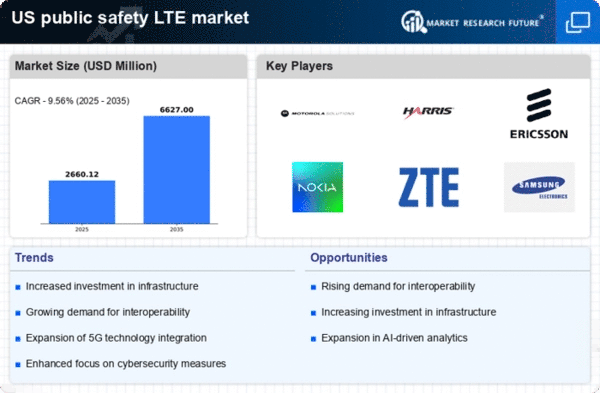

The public safety-lte market is experiencing a notable surge in demand for reliable communication systems. This demand is primarily driven by the need for uninterrupted connectivity during emergencies. Public safety agencies require robust communication networks to coordinate responses effectively. According to recent data, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the increasing recognition of the importance of reliable communication in crisis situations. As agencies invest in advanced LTE solutions, the public safety-lte market is likely to expand significantly, ensuring that first responders can communicate seamlessly in critical scenarios.