Rising Healthcare Expenditure

The increasing healthcare expenditure in the US is a significant driver for the psoriasis treatment market. As healthcare spending continues to rise, patients are more likely to seek treatment for chronic conditions such as psoriasis. In 2025, healthcare expenditure is projected to reach approximately $4 trillion, indicating a growing willingness to invest in health and wellness. This trend is likely to result in higher demand for psoriasis treatments, as patients prioritize managing their conditions effectively. Additionally, insurance coverage for advanced therapies is improving, making treatments more accessible to a broader population. Consequently, the psoriasis treatment market is expected to expand as more individuals seek effective management options for their condition.

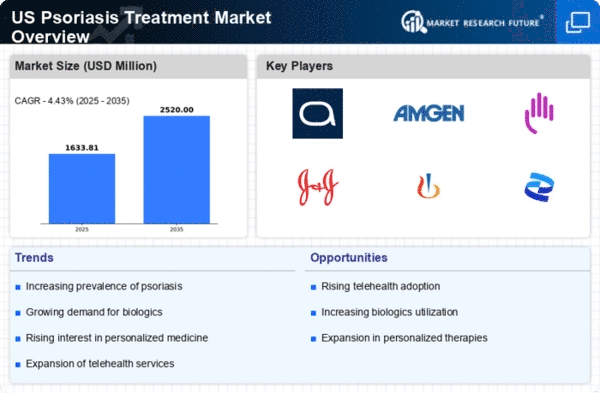

Growing Prevalence of Psoriasis

The increasing prevalence of psoriasis in the US is a primary driver for the psoriasis treatment market. Recent estimates suggest that approximately 7.5 million individuals in the US are affected by this chronic skin condition. This rising number of patients necessitates a corresponding increase in treatment options, thereby expanding the market. The psoriasis treatment market is likely to experience growth as healthcare providers seek to address the needs of this expanding patient population. Furthermore, the demand for effective therapies is heightened by the chronic nature of the disease, which often requires long-term management. As awareness of psoriasis continues to grow, the market may see a shift towards more innovative and personalized treatment solutions.

Advancements in Treatment Modalities

Innovations in treatment modalities are significantly influencing the psoriasis treatment market. The introduction of novel therapies, including biologics and targeted therapies, has transformed the landscape of psoriasis management. For instance, biologics have shown efficacy rates of up to 90% in some patients, which is a substantial improvement over traditional treatments. This advancement not only enhances patient outcomes but also drives market growth as healthcare providers increasingly adopt these new therapies. Additionally, the development of combination therapies that integrate different treatment approaches may further expand the options available to patients. As the market evolves, the focus on personalized medicine is likely to become more pronounced, catering to the unique needs of individuals suffering from psoriasis.

Regulatory Support for New Treatments

Regulatory support for the approval of new treatments is a crucial driver for the psoriasis treatment market. The US Food and Drug Administration (FDA) has streamlined the approval process for innovative therapies, which encourages pharmaceutical companies to invest in the development of new psoriasis treatments. This regulatory environment is likely to facilitate the introduction of novel therapies that can address unmet medical needs in the psoriasis population. As new treatments receive expedited approval, the market may witness a surge in available options for patients. Furthermore, the FDA's commitment to patient-centered approaches may lead to the development of therapies that are not only effective but also improve the quality of life for individuals living with psoriasis.

Increased Investment in Dermatology Research

The psoriasis treatment market is benefiting from heightened investment in dermatology research. Pharmaceutical companies and research institutions are allocating substantial resources to develop new therapies and improve existing ones. In 2025, it is estimated that the dermatology sector will see an investment increase of approximately 15%, reflecting the growing recognition of psoriasis as a significant public health issue. This influx of funding is likely to accelerate the pace of innovation, leading to the introduction of more effective treatment options. Moreover, collaborations between academia and industry are fostering a conducive environment for breakthroughs in psoriasis research. As a result, the market is poised for expansion, driven by the continuous quest for improved therapeutic solutions.